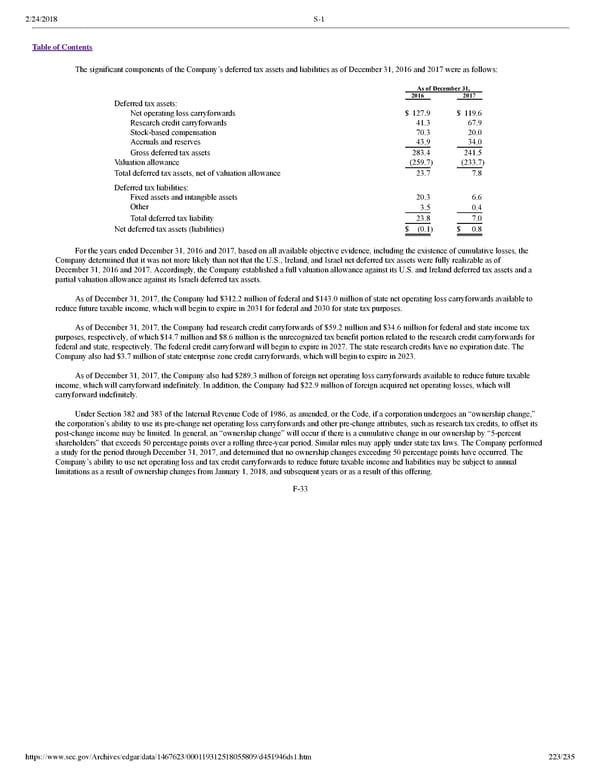

2/24/2018 S-1 Table of Contents The significant components of the Company’s deferred tax assets and liabilities as of December 31, 2016 and 2017 were as follows: As of December 31, 2016 2017 Deferred tax assets: Net operating loss carryforwards $ 127.9 $ 119.6 Research credit carryforwards 41.3 67.9 Stockbased compensation 70.3 20.0 Accruals and reserves 43.9 34.0 Gross deferred tax assets 283.4 241.5 Valuation allowance (259.7) (233.7) Total deferred tax assets, net of valuation allowance 23.7 7.8 Deferred tax liabilities: Fixed assets and intangible assets 20.3 6.6 Other 3.5 0.4 Total deferred tax liability 23.8 7.0 Net deferred tax assets (liabilities) $ (0.1) $ 0.8 For the years ended December 31, 2016 and 2017, based on all available objective evidence, including the existence of cumulative losses, the Company determined that it was not more likely than not that the U.S., Ireland, and Israel net deferred tax assets were fully realizable as of December 31, 2016 and 2017. Accordingly, the Company established a full valuation allowance against its U.S. and Ireland deferred tax assets and a partial valuation allowance against its Israeli deferred tax assets. As of December 31, 2017, the Company had $312.2 million of federal and $143.0 million of state net operating loss carryforwards available to reduce future taxable income, which will begin to expire in 2031 for federal and 2030 for state tax purposes. As of December 31, 2017, the Company had research credit carryforwards of $59.2 million and $34.6 million for federal and state income tax purposes, respectively, of which $14.7 million and $8.6 million is the unrecognized tax benefit portion related to the research credit carryforwards for federal and state, respectively. The federal credit carryforward will begin to expire in 2027. The state research credits have no expiration date. The Company also had $3.7 million of state enterprise zone credit carryforwards, which will begin to expire in 2023. As of December 31, 2017, the Company also had $289.3 million of foreign net operating loss carryforwards available to reduce future taxable income, which will carryforward indefinitely. In addition, the Company had $22.9 million of foreign acquired net operating losses, which will carryforward indefinitely. Under Section 382 and 383 of the Internal Revenue Code of 1986, as amended, or the Code, if a corporation undergoes an “ownership change,” the corporation’s ability to use its prechange net operating loss carryforwards and other prechange attributes, such as research tax credits, to offset its postchange income may be limited. In general, an “ownership change” will occur if there is a cumulative change in our ownership by “5percent shareholders” that exceeds 50 percentage points over a rolling threeyear period. Similar rules may apply under state tax laws. The Company performed a study for the period through December 31, 2017, and determined that no ownership changes exceeding 50 percentage points have occurred. The Company’s ability to use net operating loss and tax credit carryforwards to reduce future taxable income and liabilities may be subject to annual limitations as a result of ownership changes from January 1, 2018, and subsequent years or as a result of this offering. F33 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 223/235

Dropbox S-1 | Interactive Prospectus Page 222 Page 224

Dropbox S-1 | Interactive Prospectus Page 222 Page 224