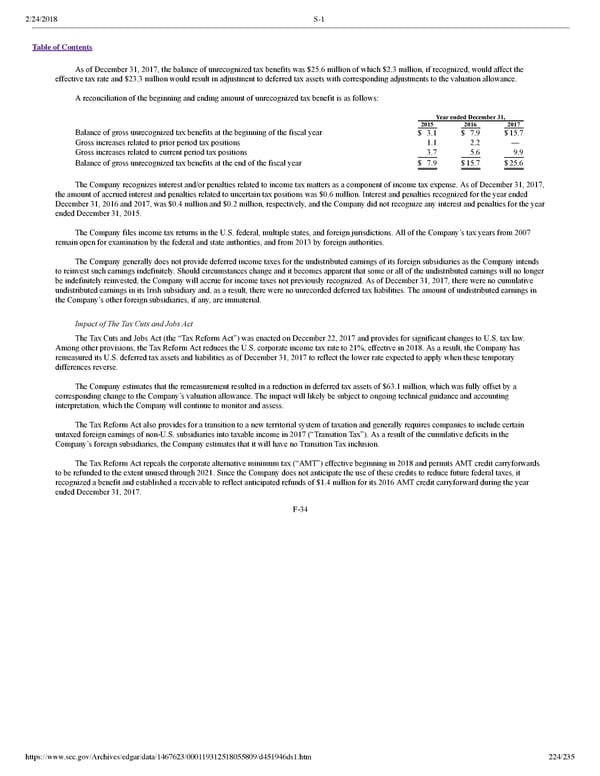

2/24/2018 S-1 Table of Contents As of December 31, 2017, the balance of unrecognized tax benefits was $25.6 million of which $2.3 million, if recognized, would affect the effective tax rate and $23.3 million would result in adjustment to deferred tax assets with corresponding adjustments to the valuation allowance. A reconciliation of the beginning and ending amount of unrecognized tax benefit is as follows: Year ended December 31, 2015 2016 2017 Balance of gross unrecognized tax benefits at the beginning of the fiscal year $ 3.1 $ 7.9 $15.7 Gross increases related to prior period tax positions 1.1 2.2 — Gross increases related to current period tax positions 3.7 5.6 9.9 Balance of gross unrecognized tax benefits at the end of the fiscal year $ 7.9 $15.7 $25.6 The Company recognizes interest and/or penalties related to income tax matters as a component of income tax expense. As of December 31, 2017, the amount of accrued interest and penalties related to uncertain tax positions was $0.6 million. Interest and penalties recognized for the year ended December 31, 2016 and 2017, was $0.4 million and $0.2 million, respectively, and the Company did not recognize any interest and penalties for the year ended December 31, 2015. The Company files income tax returns in the U.S. federal, multiple states, and foreign jurisdictions. All of the Company’s tax years from 2007 remain open for examination by the federal and state authorities, and from 2013 by foreign authorities. The Company generally does not provide deferred income taxes for the undistributed earnings of its foreign subsidiaries as the Company intends to reinvest such earnings indefinitely. Should circumstances change and it becomes apparent that some or all of the undistributed earnings will no longer be indefinitely reinvested, the Company will accrue for income taxes not previously recognized. As of December 31, 2017, there were no cumulative undistributed earnings in its Irish subsidiary and, as a result, there were no unrecorded deferred tax liabilities. The amount of undistributed earnings in the Company’s other foreign subsidiaries, if any, are immaterial. Impact of The Tax Cuts and Jobs Act The Tax Cuts and Jobs Act (the “Tax Reform Act”) was enacted on December 22, 2017 and provides for significant changes to U.S. tax law. Among other provisions, the Tax Reform Act reduces the U.S. corporate income tax rate to 21%, effective in 2018. As a result, the Company has remeasured its U.S. deferred tax assets and liabilities as of December 31, 2017 to reflect the lower rate expected to apply when these temporary differences reverse. The Company estimates that the remeasurement resulted in a reduction in deferred tax assets of $63.1 million, which was fully offset by a corresponding change to the Company’s valuation allowance. The impact will likely be subject to ongoing technical guidance and accounting interpretation, which the Company will continue to monitor and assess. The Tax Reform Act also provides for a transition to a new territorial system of taxation and generally requires companies to include certain untaxed foreign earnings of nonU.S. subsidiaries into taxable income in 2017 (“Transition Tax”). As a result of the cumulative deficits in the Company’s foreign subsidiaries, the Company estimates that it will have no Transition Tax inclusion. The Tax Reform Act repeals the corporate alternative minimum tax (“AMT”) effective beginning in 2018 and permits AMT credit carryforwards to be refunded to the extent unused through 2021. Since the Company does not anticipate the use of these credits to reduce future federal taxes, it recognized a benefit and established a receivable to reflect anticipated refunds of $1.4 million for its 2016 AMT credit carryforward during the year ended December 31, 2017. F34 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 224/235

Dropbox S-1 | Interactive Prospectus Page 223 Page 225

Dropbox S-1 | Interactive Prospectus Page 223 Page 225