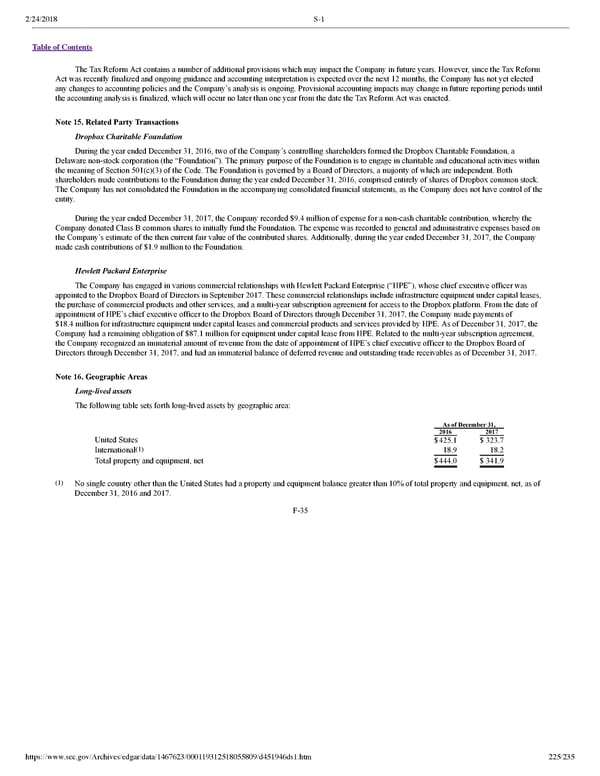

2/24/2018 S-1 Table of Contents The Tax Reform Act contains a number of additional provisions which may impact the Company in future years. However, since the Tax Reform Act was recently finalized and ongoing guidance and accounting interpretation is expected over the next 12 months, the Company has not yet elected any changes to accounting policies and the Company’s analysis is ongoing. Provisional accounting impacts may change in future reporting periods until the accounting analysis is finalized, which will occur no later than one year from the date the Tax Reform Act was enacted. Note 15. Related Party Transactions Dropbox Charitable Foundation During the year ended December 31, 2016, two of the Company’s controlling shareholders formed the Dropbox Charitable Foundation, a Delaware nonstock corporation (the “Foundation”). The primary purpose of the Foundation is to engage in charitable and educational activities within the meaning of Section 501(c)(3) of the Code. The Foundation is governed by a Board of Directors, a majority of which are independent. Both shareholders made contributions to the Foundation during the year ended December 31, 2016, comprised entirely of shares of Dropbox common stock. The Company has not consolidated the Foundation in the accompanying consolidated financial statements, as the Company does not have control of the entity. During the year ended December 31, 2017, the Company recorded $9.4 million of expense for a noncash charitable contribution, whereby the Company donated Class B common shares to initially fund the Foundation. The expense was recorded to general and administrative expenses based on the Company’s estimate of the then current fair value of the contributed shares. Additionally, during the year ended December 31, 2017, the Company made cash contributions of $1.9 million to the Foundation. Hewlett Packard Enterprise The Company has engaged in various commercial relationships with Hewlett Packard Enterprise (“HPE”), whose chief executive officer was appointed to the Dropbox Board of Directors in September 2017. These commercial relationships include infrastructure equipment under capital leases, the purchase of commercial products and other services, and a multiyear subscription agreement for access to the Dropbox platform. From the date of appointment of HPE’s chief executive officer to the Dropbox Board of Directors through December 31, 2017, the Company made payments of $18.4 million for infrastructure equipment under capital leases and commercial products and services provided by HPE. As of December 31, 2017, the Company had a remaining obligation of $87.1 million for equipment under capital lease from HPE. Related to the multiyear subscription agreement, the Company recognized an immaterial amount of revenue from the date of appointment of HPE’s chief executive officer to the Dropbox Board of Directors through December 31, 2017, and had an immaterial balance of deferred revenue and outstanding trade receivables as of December 31, 2017. Note 16. Geographic Areas Longlived assets The following table sets forth longlived assets by geographic area: As of December 31, 2016 2017 United States $425.1 $ 323.7 (1) International 18.9 18.2 Total property and equipment, net $444.0 $ 341.9 (1) No single country other than the United States had a property and equipment balance greater than 10% of total property and equipment, net, as of December 31, 2016 and 2017. F35 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 225/235

Dropbox S-1 | Interactive Prospectus Page 224 Page 226

Dropbox S-1 | Interactive Prospectus Page 224 Page 226