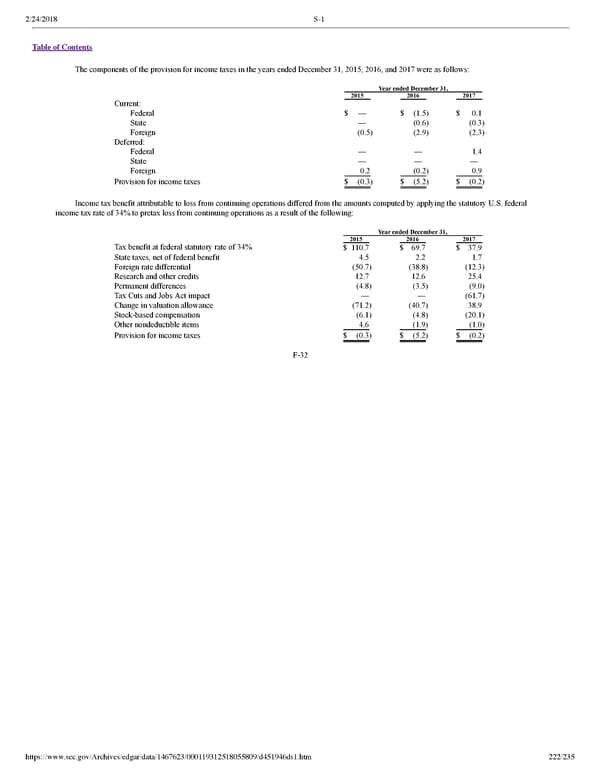

2/24/2018 S-1 Table of Contents The components of the provision for income taxes in the years ended December 31, 2015, 2016, and 2017 were as follows: Year ended December 31, 2015 2016 2017 Current: Federal $ — $ (1.5) $ 0.1 State — (0.6) (0.3) Foreign (0.5) (2.9) (2.3) Deferred: Federal — — 1.4 State — — — Foreign 0.2 (0.2) 0.9 Provision for income taxes $ (0.3) $ (5.2) $ (0.2) Income tax benefit attributable to loss from continuing operations differed from the amounts computed by applying the statutory U.S. federal income tax rate of 34% to pretax loss from continuing operations as a result of the following: Year ended December 31, 2015 2016 2017 Tax benefit at federal statutory rate of 34% $ 110.7 $ 69.7 $ 37.9 State taxes, net of federal benefit 4.5 2.2 1.7 Foreign rate differential (50.7) (38.8) (12.3) Research and other credits 12.7 12.6 25.4 Permanent differences (4.8) (3.5) (9.0) Tax Cuts and Jobs Act impact — — (61.7) Change in valuation allowance (71.2) (40.7) 38.9 Stockbased compensation (6.1) (4.8) (20.1) Other nondeductible items 4.6 (1.9) (1.0) Provision for income taxes $ (0.3) $ (5.2) $ (0.2) F32 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 222/235

Dropbox S-1 | Interactive Prospectus Page 221 Page 223

Dropbox S-1 | Interactive Prospectus Page 221 Page 223