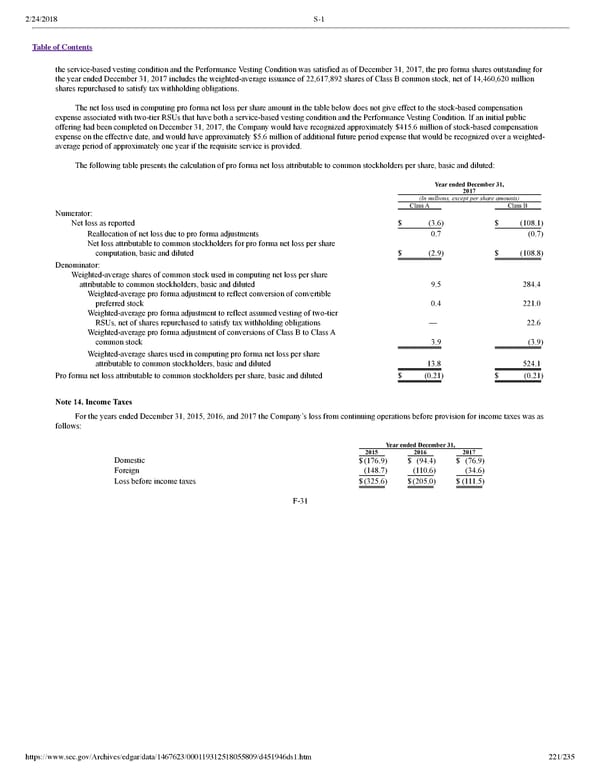

2/24/2018 S-1 Table of Contents the servicebased vesting condition and the Performance Vesting Condition was satisfied as of December 31, 2017, the pro forma shares outstanding for the year ended December 31, 2017 includes the weightedaverage issuance of 22,617,892 shares of Class B common stock, net of 14,460,620 million shares repurchased to satisfy tax withholding obligations. The net loss used in computing pro forma net loss per share amount in the table below does not give effect to the stockbased compensation expense associated with twotier RSUs that have both a servicebased vesting condition and the Performance Vesting Condition. If an initial public offering had been completed on December 31, 2017, the Company would have recognized approximately $415.6 million of stockbased compensation expense on the effective date, and would have approximately $5.6 million of additional future period expense that would be recognized over a weighted average period of approximately one year if the requisite service is provided. The following table presents the calculation of pro forma net loss attributable to common stockholders per share, basic and diluted: Year ended December 31, 2017 (In millions, except per share amounts) Class A Class B Numerator: Net loss as reported $ (3.6) $ (108.1) Reallocation of net loss due to pro forma adjustments 0.7 (0.7) Net loss attributable to common stockholders for pro forma net loss per share computation, basic and diluted $ (2.9) $ (108.8) Denominator: Weightedaverage shares of common stock used in computing net loss per share attributable to common stockholders, basic and diluted 9.5 284.4 Weightedaverage pro forma adjustment to reflect conversion of convertible preferred stock 0.4 221.0 Weightedaverage pro forma adjustment to reflect assumed vesting of twotier RSUs, net of shares repurchased to satisfy tax withholding obligations — 22.6 Weightedaverage pro forma adjustment of conversions of Class B to Class A common stock 3.9 (3.9) Weightedaverage shares used in computing pro forma net loss per share attributable to common stockholders, basic and diluted 13.8 524.1 Pro forma net loss attributable to common stockholders per share, basic and diluted $ (0.21) $ (0.21) Note 14. Income Taxes For the years ended December 31, 2015, 2016, and 2017 the Company’s loss from continuing operations before provision for income taxes was as follows: Year ended December 31, 2015 2016 2017 Domestic $(176.9) $ (94.4) $ (76.9) Foreign (148.7) (110.6) (34.6) Loss before income taxes $(325.6) $(205.0) $(111.5) F31 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 221/235

Dropbox S-1 | Interactive Prospectus Page 220 Page 222

Dropbox S-1 | Interactive Prospectus Page 220 Page 222