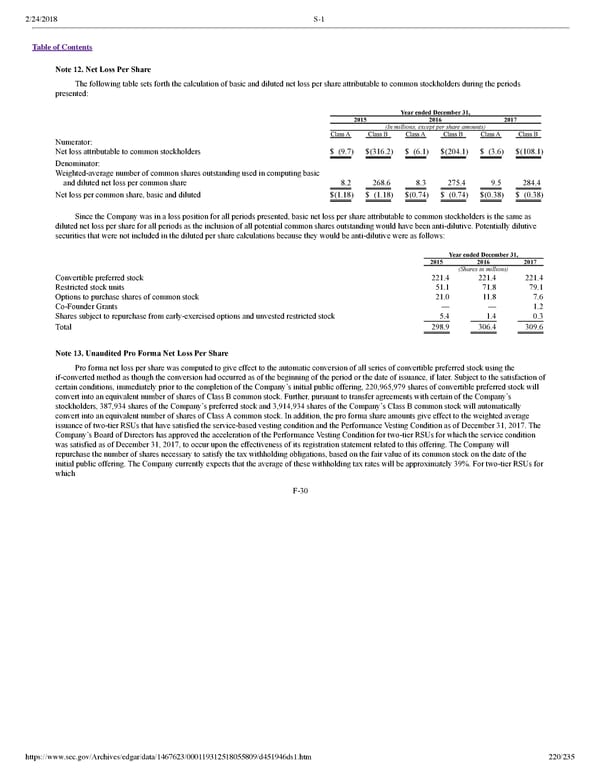

2/24/2018 S-1 Table of Contents Note 12. Net Loss Per Share The following table sets forth the calculation of basic and diluted net loss per share attributable to common stockholders during the periods presented: Year ended December 31, 2015 2016 2017 (In millions, except per share amounts) Class A Class B Class A Class B Class A Class B Numerator: Net loss attributable to common stockholders $ (9.7) $(316.2) $ (6.1) $(204.1) $ (3.6) $(108.1) Denominator: Weightedaverage number of common shares outstanding used in computing basic and diluted net loss per common share 8.2 268.6 8.3 275.4 9.5 284.4 Net loss per common share, basic and diluted $(1.18) $ (1.18) $(0.74) $ (0.74) $(0.38) $ (0.38) Since the Company was in a loss position for all periods presented, basic net loss per share attributable to common stockholders is the same as diluted net loss per share for all periods as the inclusion of all potential common shares outstanding would have been antidilutive. Potentially dilutive securities that were not included in the diluted per share calculations because they would be antidilutive were as follows: Year ended December 31, 2015 2016 2017 (Shares in millions) Convertible preferred stock 221.4 221.4 221.4 Restricted stock units 51.1 71.8 79.1 Options to purchase shares of common stock 21.0 11.8 7.6 CoFounder Grants — — 1.2 Shares subject to repurchase from earlyexercised options and unvested restricted stock 5.4 1.4 0.3 Total 298.9 306.4 309.6 Note 13. Unaudited Pro Forma Net Loss Per Share Pro forma net loss per share was computed to give effect to the automatic conversion of all series of convertible preferred stock using the ifconverted method as though the conversion had occurred as of the beginning of the period or the date of issuance, if later. Subject to the satisfaction of certain conditions, immediately prior to the completion of the Company’s initial public offering, 220,965,979 shares of convertible preferred stock will convert into an equivalent number of shares of Class B common stock. Further, pursuant to transfer agreements with certain of the Company’s stockholders, 387,934 shares of the Company’s preferred stock and 3,914,934 shares of the Company’s Class B common stock will automatically convert into an equivalent number of shares of Class A common stock. In addition, the pro forma share amounts give effect to the weighted average issuance of twotier RSUs that have satisfied the servicebased vesting condition and the Performance Vesting Condition as of December 31, 2017. The Company’s Board of Directors has approved the acceleration of the Performance Vesting Condition for twotier RSUs for which the service condition was satisfied as of December 31, 2017, to occur upon the effectiveness of its registration statement related to this offering. The Company will repurchase the number of shares necessary to satisfy the tax withholding obligations, based on the fair value of its common stock on the date of the initial public offering. The Company currently expects that the average of these withholding tax rates will be approximately 39%. For twotier RSUs for which F30 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 220/235

Dropbox S-1 | Interactive Prospectus Page 219 Page 221

Dropbox S-1 | Interactive Prospectus Page 219 Page 221