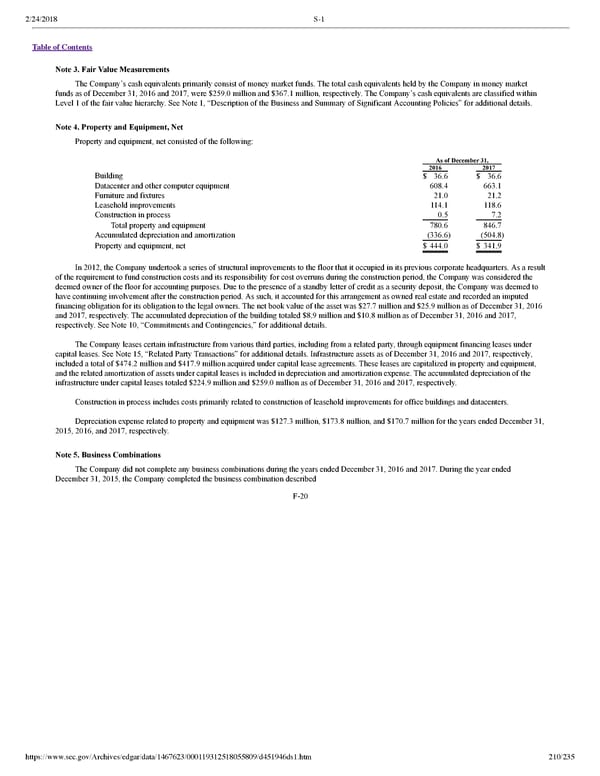

2/24/2018 S-1 Table of Contents Note 3. Fair Value Measurements The Company’s cash equivalents primarily consist of money market funds. The total cash equivalents held by the Company in money market funds as of December 31, 2016 and 2017, were $259.0 million and $367.1 million, respectively. The Company’s cash equivalents are classified within Level 1 of the fair value hierarchy. See Note 1, “Description of the Business and Summary of Significant Accounting Policies” for additional details. Note 4. Property and Equipment, Net Property and equipment, net consisted of the following: As of December 31, 2016 2017 Building $ 36.6 $ 36.6 Datacenter and other computer equipment 608.4 663.1 Furniture and fixtures 21.0 21.2 Leasehold improvements 114.1 118.6 Construction in process 0.5 7.2 Total property and equipment 780.6 846.7 Accumulated depreciation and amortization (336.6) (504.8) Property and equipment, net $ 444.0 $ 341.9 In 2012, the Company undertook a series of structural improvements to the floor that it occupied in its previous corporate headquarters. As a result of the requirement to fund construction costs and its responsibility for cost overruns during the construction period, the Company was considered the deemed owner of the floor for accounting purposes. Due to the presence of a standby letter of credit as a security deposit, the Company was deemed to have continuing involvement after the construction period. As such, it accounted for this arrangement as owned real estate and recorded an imputed financing obligation for its obligation to the legal owners. The net book value of the asset was $27.7 million and $25.9 million as of December 31, 2016 and 2017, respectively. The accumulated depreciation of the building totaled $8.9 million and $10.8 million as of December 31, 2016 and 2017, respectively. See Note 10, “Commitments and Contingencies,” for additional details. The Company leases certain infrastructure from various third parties, including from a related party, through equipment financing leases under capital leases. See Note 15, “Related Party Transactions” for additional details. Infrastructure assets as of December 31, 2016 and 2017, respectively, included a total of $474.2 million and $417.9 million acquired under capital lease agreements. These leases are capitalized in property and equipment, and the related amortization of assets under capital leases is included in depreciation and amortization expense. The accumulated depreciation of the infrastructure under capital leases totaled $224.9 million and $259.0 million as of December 31, 2016 and 2017, respectively. Construction in process includes costs primarily related to construction of leasehold improvements for office buildings and datacenters. Depreciation expense related to property and equipment was $127.3 million, $173.8 million, and $170.7 million for the years ended December 31, 2015, 2016, and 2017, respectively. Note 5. Business Combinations The Company did not complete any business combinations during the years ended December 31, 2016 and 2017. During the year ended December 31, 2015, the Company completed the business combination described F20 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 210/235

Dropbox S-1 | Interactive Prospectus Page 209 Page 211

Dropbox S-1 | Interactive Prospectus Page 209 Page 211