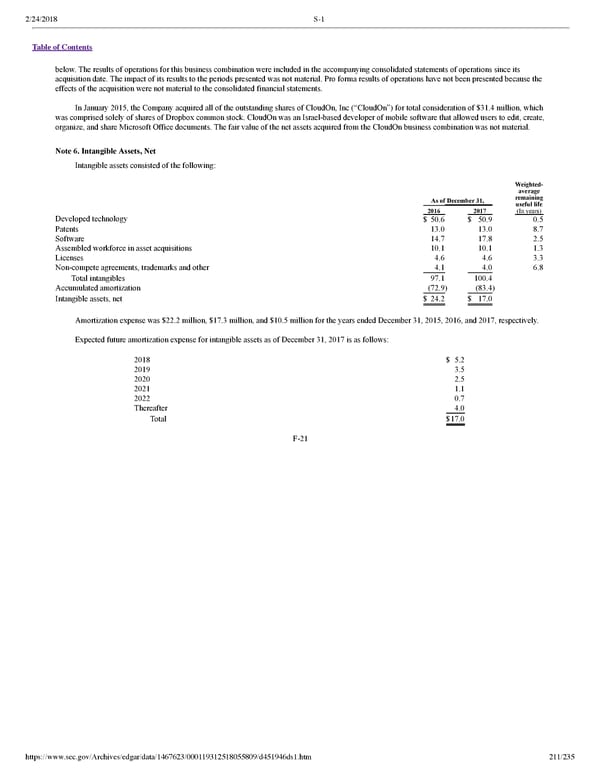

2/24/2018 S-1 Table of Contents below. The results of operations for this business combination were included in the accompanying consolidated statements of operations since its acquisition date. The impact of its results to the periods presented was not material. Pro forma results of operations have not been presented because the effects of the acquisition were not material to the consolidated financial statements. In January 2015, the Company acquired all of the outstanding shares of CloudOn, Inc (“CloudOn”) for total consideration of $31.4 million, which was comprised solely of shares of Dropbox common stock. CloudOn was an Israelbased developer of mobile software that allowed users to edit, create, organize, and share Microsoft Office documents. The fair value of the net assets acquired from the CloudOn business combination was not material. Note 6. Intangible Assets, Net Intangible assets consisted of the following: Weighted average remaining As of December 31, useful life 2016 2017 (In years) Developed technology $ 50.6 $ 50.9 0.5 Patents 13.0 13.0 8.7 Software 14.7 17.8 2.5 Assembled workforce in asset acquisitions 10.1 10.1 1.3 Licenses 4.6 4.6 3.3 Noncompete agreements, trademarks and other 4.1 4.0 6.8 Total intangibles 97.1 100.4 Accumulated amortization (72.9) (83.4) Intangible assets, net $ 24.2 $ 17.0 Amortization expense was $22.2 million, $17.3 million, and $10.5 million for the years ended December 31, 2015, 2016, and 2017, respectively. Expected future amortization expense for intangible assets as of December 31, 2017 is as follows: 2018 $ 5.2 2019 3.5 2020 2.5 2021 1.1 2022 0.7 Thereafter 4.0 Total $17.0 F21 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 211/235

Dropbox S-1 | Interactive Prospectus Page 210 Page 212

Dropbox S-1 | Interactive Prospectus Page 210 Page 212