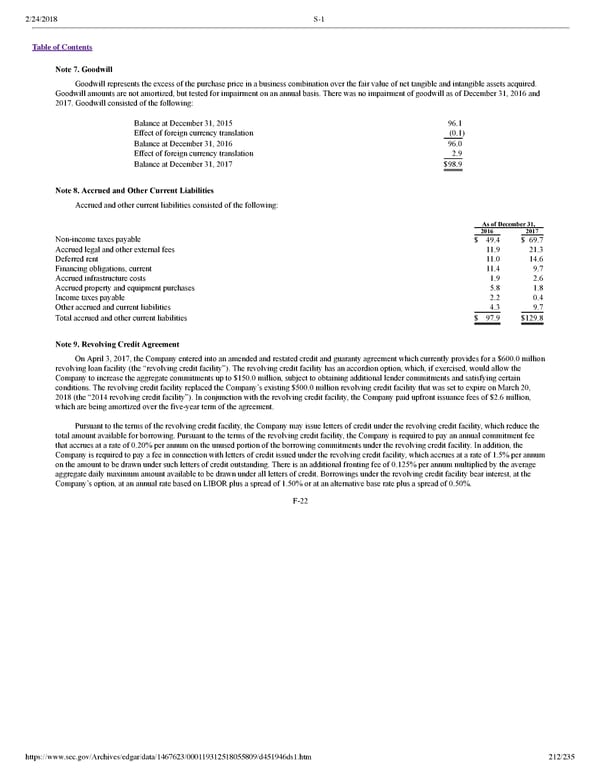

2/24/2018 S-1 Table of Contents Note 7. Goodwill Goodwill represents the excess of the purchase price in a business combination over the fair value of net tangible and intangible assets acquired. Goodwill amounts are not amortized, but tested for impairment on an annual basis. There was no impairment of goodwill as of December 31, 2016 and 2017. Goodwill consisted of the following: Balance at December 31, 2015 96.1 Effect of foreign currency translation (0.1) Balance at December 31, 2016 96.0 Effect of foreign currency translation 2.9 Balance at December 31, 2017 $98.9 Note 8. Accrued and Other Current Liabilities Accrued and other current liabilities consisted of the following: As of December 31, 2016 2017 Nonincome taxes payable $ 49.4 $ 69.7 Accrued legal and other external fees 11.9 21.3 Deferred rent 11.0 14.6 Financing obligations, current 11.4 9.7 Accrued infrastructure costs 1.9 2.6 Accrued property and equipment purchases 5.8 1.8 Income taxes payable 2.2 0.4 Other accrued and current liabilities 4.3 9.7 Total accrued and other current liabilities $ 97.9 $129.8 Note 9. Revolving Credit Agreement On April 3, 2017, the Company entered into an amended and restated credit and guaranty agreement which currently provides for a $600.0 million revolving loan facility (the “revolving credit facility”). The revolving credit facility has an accordion option, which, if exercised, would allow the Company to increase the aggregate commitments up to $150.0 million, subject to obtaining additional lender commitments and satisfying certain conditions. The revolving credit facility replaced the Company’s existing $500.0 million revolving credit facility that was set to expire on March 20, 2018 (the “2014 revolving credit facility”). In conjunction with the revolving credit facility, the Company paid upfront issuance fees of $2.6 million, which are being amortized over the fiveyear term of the agreement. Pursuant to the terms of the revolving credit facility, the Company may issue letters of credit under the revolving credit facility, which reduce the total amount available for borrowing. Pursuant to the terms of the revolving credit facility, the Company is required to pay an annual commitment fee that accrues at a rate of 0.20% per annum on the unused portion of the borrowing commitments under the revolving credit facility. In addition, the Company is required to pay a fee in connection with letters of credit issued under the revolving credit facility, which accrues at a rate of 1.5% per annum on the amount to be drawn under such letters of credit outstanding. There is an additional fronting fee of 0.125% per annum multiplied by the average aggregate daily maximum amount available to be drawn under all letters of credit. Borrowings under the revolving credit facility bear interest, at the Company’s option, at an annual rate based on LIBOR plus a spread of 1.50% or at an alternative base rate plus a spread of 0.50%. F22 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 212/235

Dropbox S-1 | Interactive Prospectus Page 211 Page 213

Dropbox S-1 | Interactive Prospectus Page 211 Page 213