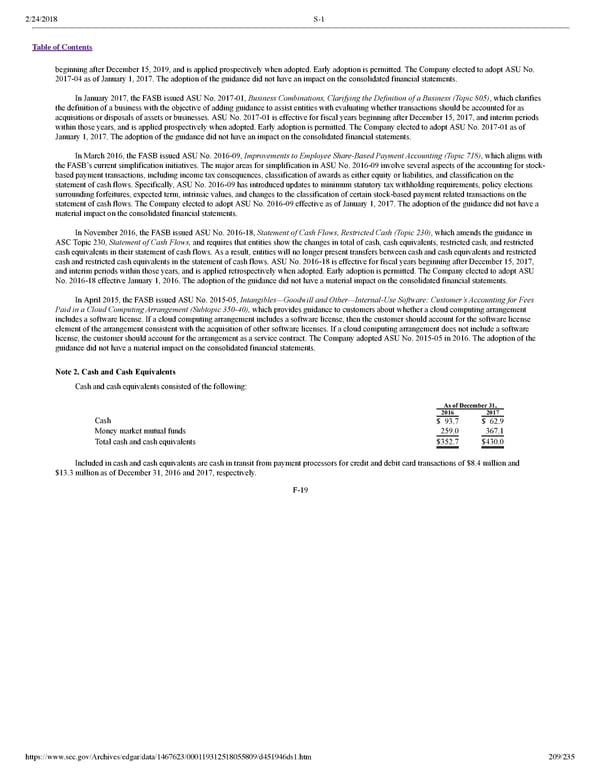

2/24/2018 S-1 Table of Contents beginning after December 15, 2019, and is applied prospectively when adopted. Early adoption is permitted. The Company elected to adopt ASU No. 201704 as of January 1, 2017. The adoption of the guidance did not have an impact on the consolidated financial statements. In January 2017, the FASB issued ASU No. 201701, Business Combinations, Clarifying the Definition of a Business (Topic 805), which clarifies the definition of a business with the objective of adding guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions or disposals of assets or businesses. ASU No. 201701 is effective for fiscal years beginning after December 15, 2017, and interim periods within those years, and is applied prospectively when adopted. Early adoption is permitted. The Company elected to adopt ASU No. 201701 as of January 1, 2017. The adoption of the guidance did not have an impact on the consolidated financial statements. In March 2016, the FASB issued ASU No. 201609, Improvements to Employee ShareBased Payment Accounting (Topic 718), which aligns with the FASB’s current simplification initiatives. The major areas for simplification in ASU No. 201609 involve several aspects of the accounting for stock based payment transactions, including income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. Specifically, ASU No. 201609 has introduced updates to minimum statutory tax withholding requirements, policy elections surrounding forfeitures, expected term, intrinsic values, and changes to the classification of certain stockbased payment related transactions on the statement of cash flows. The Company elected to adopt ASU No. 201609 effective as of January 1, 2017. The adoption of the guidance did not have a material impact on the consolidated financial statements. In November 2016, the FASB issued ASU No. 201618, Statement of Cash Flows, Restricted Cash (Topic 230), which amends the guidance in ASC Topic 230, Statement of Cash Flows, and requires that entities show the changes in total of cash, cash equivalents, restricted cash, and restricted cash equivalents in their statement of cash flows. As a result, entities will no longer present transfers between cash and cash equivalents and restricted cash and restricted cash equivalents in the statement of cash flows. ASU No. 201618 is effective for fiscal years beginning after December 15, 2017, and interim periods within those years, and is applied retrospectively when adopted. Early adoption is permitted. The Company elected to adopt ASU No. 201618 effective January 1, 2016. The adoption of the guidance did not have a material impact on the consolidated financial statements. In April 2015, the FASB issued ASU No. 201505, Intangibles—Goodwill and Other—InternalUse Software: Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement (Subtopic 35040), which provides guidance to customers about whether a cloud computing arrangement includes a software license. If a cloud computing arrangement includes a software license, then the customer should account for the software license element of the arrangement consistent with the acquisition of other software licenses. If a cloud computing arrangement does not include a software license, the customer should account for the arrangement as a service contract. The Company adopted ASU No. 201505 in 2016. The adoption of the guidance did not have a material impact on the consolidated financial statements. Note 2. Cash and Cash Equivalents Cash and cash equivalents consisted of the following: As of December 31, 2016 2017 Cash $ 93.7 $ 62.9 Money market mutual funds 259.0 367.1 Total cash and cash equivalents $352.7 $430.0 Included in cash and cash equivalents are cash in transit from payment processors for credit and debit card transactions of $8.4 million and $13.3 million as of December 31, 2016 and 2017, respectively. F19 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 209/235

Dropbox S-1 | Interactive Prospectus Page 208 Page 210

Dropbox S-1 | Interactive Prospectus Page 208 Page 210