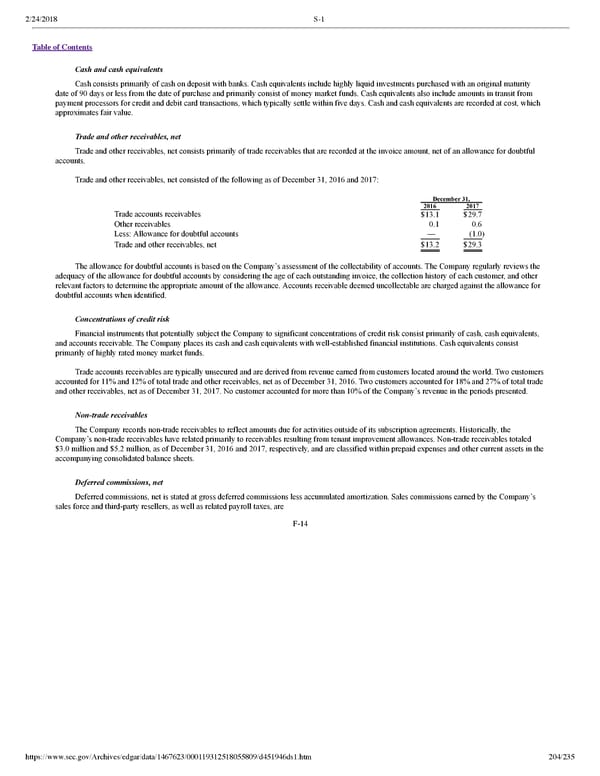

2/24/2018 S-1 Table of Contents Cash and cash equivalents Cash consists primarily of cash on deposit with banks. Cash equivalents include highly liquid investments purchased with an original maturity date of 90 days or less from the date of purchase and primarily consist of money market funds. Cash equivalents also include amounts in transit from payment processors for credit and debit card transactions, which typically settle within five days. Cash and cash equivalents are recorded at cost, which approximates fair value. Trade and other receivables, net Trade and other receivables, net consists primarily of trade receivables that are recorded at the invoice amount, net of an allowance for doubtful accounts. Trade and other receivables, net consisted of the following as of December 31, 2016 and 2017: December 31, 2016 2017 Trade accounts receivables $13.1 $29.7 Other receivables 0.1 0.6 Less: Allowance for doubtful accounts — (1.0) Trade and other receivables, net $13.2 $29.3 The allowance for doubtful accounts is based on the Company’s assessment of the collectability of accounts. The Company regularly reviews the adequacy of the allowance for doubtful accounts by considering the age of each outstanding invoice, the collection history of each customer, and other relevant factors to determine the appropriate amount of the allowance. Accounts receivable deemed uncollectable are charged against the allowance for doubtful accounts when identified. Concentrations of credit risk Financial instruments that potentially subject the Company to significant concentrations of credit risk consist primarily of cash, cash equivalents, and accounts receivable. The Company places its cash and cash equivalents with wellestablished financial institutions. Cash equivalents consist primarily of highly rated money market funds. Trade accounts receivables are typically unsecured and are derived from revenue earned from customers located around the world. Two customers accounted for 11% and 12% of total trade and other receivables, net as of December 31, 2016. Two customers accounted for 18% and 27% of total trade and other receivables, net as of December 31, 2017. No customer accounted for more than 10% of the Company’s revenue in the periods presented. Nontrade receivables The Company records nontrade receivables to reflect amounts due for activities outside of its subscription agreements. Historically, the Company’s nontrade receivables have related primarily to receivables resulting from tenant improvement allowances. Nontrade receivables totaled $3.0 million and $5.2 million, as of December 31, 2016 and 2017, respectively, and are classified within prepaid expenses and other current assets in the accompanying consolidated balance sheets. Deferred commissions, net Deferred commissions, net is stated at gross deferred commissions less accumulated amortization. Sales commissions earned by the Company’s sales force and thirdparty resellers, as well as related payroll taxes, are F14 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 204/235

Dropbox S-1 | Interactive Prospectus Page 203 Page 205

Dropbox S-1 | Interactive Prospectus Page 203 Page 205