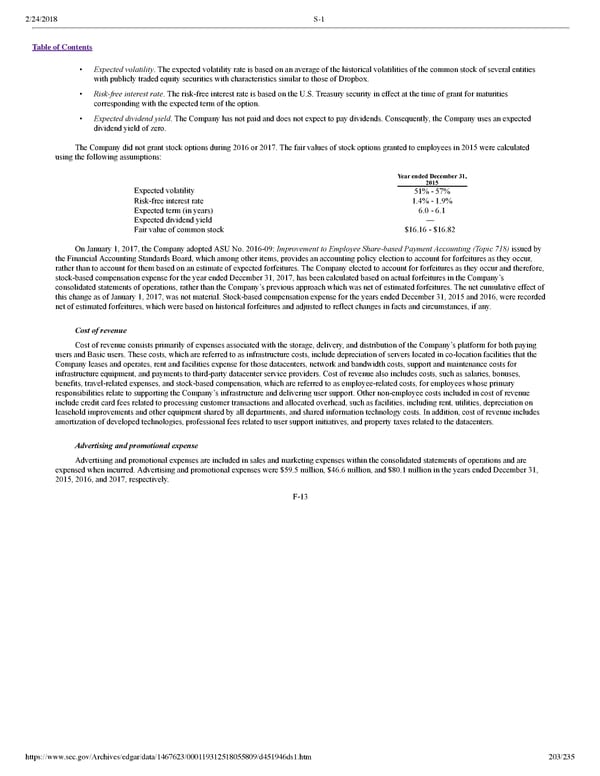

2/24/2018 S-1 Table of Contents • Expected volatility. The expected volatility rate is based on an average of the historical volatilities of the common stock of several entities with publicly traded equity securities with characteristics similar to those of Dropbox. • Riskfree interest rate. The riskfree interest rate is based on the U.S. Treasury security in effect at the time of grant for maturities corresponding with the expected term of the option. • Expected dividend yield. The Company has not paid and does not expect to pay dividends. Consequently, the Company uses an expected dividend yield of zero. The Company did not grant stock options during 2016 or 2017. The fair values of stock options granted to employees in 2015 were calculated using the following assumptions: Year ended December 31, 2015 Expected volatility 51% 57% Riskfree interest rate 1.4% 1.9% Expected term (in years) 6.0 6.1 Expected dividend yield — Fair value of common stock $16.16 $16.82 On January 1, 2017, the Company adopted ASU No. 201609: Improvement to Employee Sharebased Payment Accounting (Topic 718) issued by the Financial Accounting Standards Board, which among other items, provides an accounting policy election to account for forfeitures as they occur, rather than to account for them based on an estimate of expected forfeitures. The Company elected to account for forfeitures as they occur and therefore, stockbased compensation expense for the year ended December 31, 2017, has been calculated based on actual forfeitures in the Company’s consolidated statements of operations, rather than the Company’s previous approach which was net of estimated forfeitures. The net cumulative effect of this change as of January 1, 2017, was not material. Stockbased compensation expense for the years ended December 31, 2015 and 2016, were recorded net of estimated forfeitures, which were based on historical forfeitures and adjusted to reflect changes in facts and circumstances, if any. Cost of revenue Cost of revenue consists primarily of expenses associated with the storage, delivery, and distribution of the Company’s platform for both paying users and Basic users. These costs, which are referred to as infrastructure costs, include depreciation of servers located in colocation facilities that the Company leases and operates, rent and facilities expense for those datacenters, network and bandwidth costs, support and maintenance costs for infrastructure equipment, and payments to thirdparty datacenter service providers. Cost of revenue also includes costs, such as salaries, bonuses, benefits, travelrelated expenses, and stockbased compensation, which are referred to as employeerelated costs, for employees whose primary responsibilities relate to supporting the Company’s infrastructure and delivering user support. Other nonemployee costs included in cost of revenue include credit card fees related to processing customer transactions and allocated overhead, such as facilities, including rent, utilities, depreciation on leasehold improvements and other equipment shared by all departments, and shared information technology costs. In addition, cost of revenue includes amortization of developed technologies, professional fees related to user support initiatives, and property taxes related to the datacenters. Advertising and promotional expense Advertising and promotional expenses are included in sales and marketing expenses within the consolidated statements of operations and are expensed when incurred. Advertising and promotional expenses were $59.5 million, $46.6 million, and $80.1 million in the years ended December 31, 2015, 2016, and 2017, respectively. F13 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 203/235

Dropbox S-1 | Interactive Prospectus Page 202 Page 204

Dropbox S-1 | Interactive Prospectus Page 202 Page 204