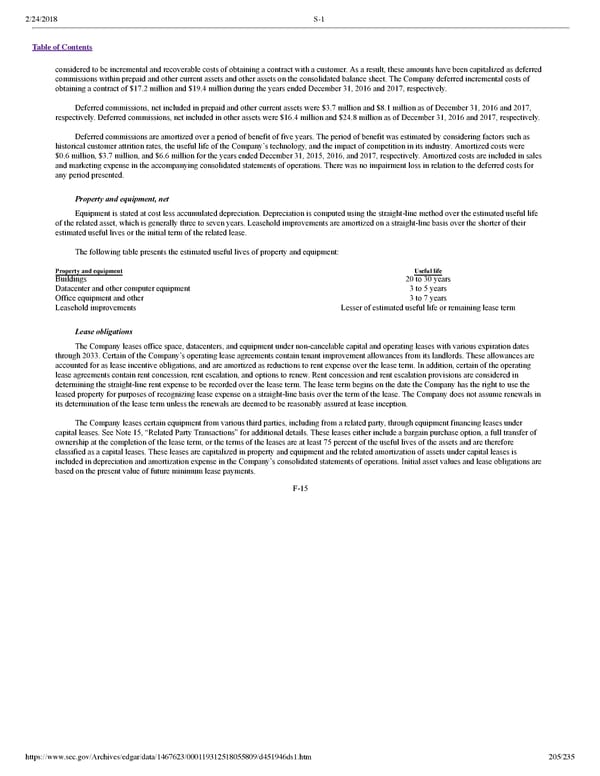

2/24/2018 S-1 Table of Contents considered to be incremental and recoverable costs of obtaining a contract with a customer. As a result, these amounts have been capitalized as deferred commissions within prepaid and other current assets and other assets on the consolidated balance sheet. The Company deferred incremental costs of obtaining a contract of $17.2 million and $19.4 million during the years ended December 31, 2016 and 2017, respectively. Deferred commissions, net included in prepaid and other current assets were $3.7 million and $8.1 million as of December 31, 2016 and 2017, respectively. Deferred commissions, net included in other assets were $16.4 million and $24.8 million as of December 31, 2016 and 2017, respectively. Deferred commissions are amortized over a period of benefit of five years. The period of benefit was estimated by considering factors such as historical customer attrition rates, the useful life of the Company’s technology, and the impact of competition in its industry. Amortized costs were $0.6 million, $3.7 million, and $6.6 million for the years ended December 31, 2015, 2016, and 2017, respectively. Amortized costs are included in sales and marketing expense in the accompanying consolidated statements of operations. There was no impairment loss in relation to the deferred costs for any period presented. Property and equipment, net Equipment is stated at cost less accumulated depreciation. Depreciation is computed using the straightline method over the estimated useful life of the related asset, which is generally three to seven years. Leasehold improvements are amortized on a straightline basis over the shorter of their estimated useful lives or the initial term of the related lease. The following table presents the estimated useful lives of property and equipment: Property and equipment Useful life Buildings 20 to 30 years Datacenter and other computer equipment 3 to 5 years Office equipment and other 3 to 7 years Leasehold improvements Lesser of estimated useful life or remaining lease term Lease obligations The Company leases office space, datacenters, and equipment under noncancelable capital and operating leases with various expiration dates through 2033. Certain of the Company’s operating lease agreements contain tenant improvement allowances from its landlords. These allowances are accounted for as lease incentive obligations, and are amortized as reductions to rent expense over the lease term. In addition, certain of the operating lease agreements contain rent concession, rent escalation, and options to renew. Rent concession and rent escalation provisions are considered in determining the straightline rent expense to be recorded over the lease term. The lease term begins on the date the Company has the right to use the leased property for purposes of recognizing lease expense on a straightline basis over the term of the lease. The Company does not assume renewals in its determination of the lease term unless the renewals are deemed to be reasonably assured at lease inception. The Company leases certain equipment from various third parties, including from a related party, through equipment financing leases under capital leases. See Note 15, “Related Party Transactions” for additional details. These leases either include a bargain purchase option, a full transfer of ownership at the completion of the lease term, or the terms of the leases are at least 75 percent of the useful lives of the assets and are therefore classified as a capital leases. These leases are capitalized in property and equipment and the related amortization of assets under capital leases is included in depreciation and amortization expense in the Company’s consolidated statements of operations. Initial asset values and lease obligations are based on the present value of future minimum lease payments. F15 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 205/235

Dropbox S-1 | Interactive Prospectus Page 204 Page 206

Dropbox S-1 | Interactive Prospectus Page 204 Page 206