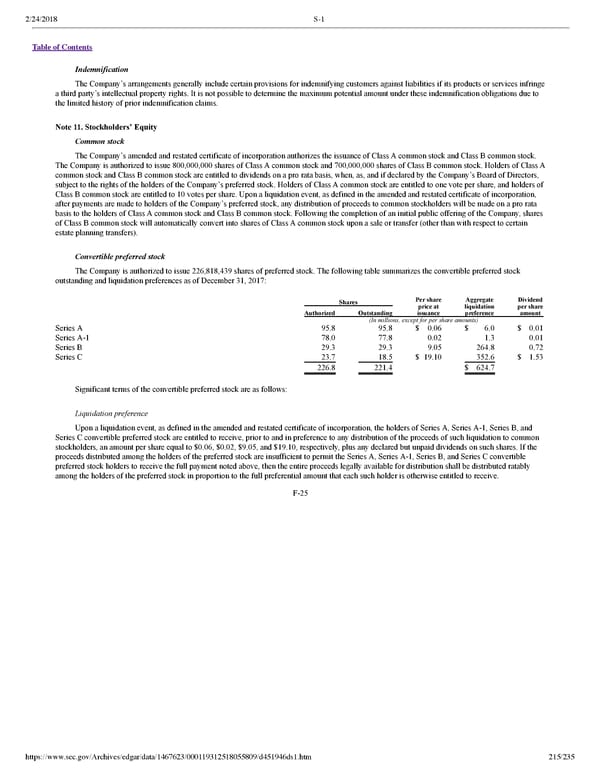

2/24/2018 S-1 Table of Contents Indemnification The Company’s arrangements generally include certain provisions for indemnifying customers against liabilities if its products or services infringe a third party’s intellectual property rights. It is not possible to determine the maximum potential amount under these indemnification obligations due to the limited history of prior indemnification claims. Note 11. Stockholders’ Equity Common stock The Company’s amended and restated certificate of incorporation authorizes the issuance of Class A common stock and Class B common stock. The Company is authorized to issue 800,000,000 shares of Class A common stock and 700,000,000 shares of Class B common stock. Holders of Class A common stock and Class B common stock are entitled to dividends on a pro rata basis, when, as, and if declared by the Company’s Board of Directors, subject to the rights of the holders of the Company’s preferred stock. Holders of Class A common stock are entitled to one vote per share, and holders of Class B common stock are entitled to 10 votes per share. Upon a liquidation event, as defined in the amended and restated certificate of incorporation, after payments are made to holders of the Company’s preferred stock, any distribution of proceeds to common stockholders will be made on a pro rata basis to the holders of Class A common stock and Class B common stock. Following the completion of an initial public offering of the Company, shares of Class B common stock will automatically convert into shares of Class A common stock upon a sale or transfer (other than with respect to certain estate planning transfers). Convertible preferred stock The Company is authorized to issue 226,818,439 shares of preferred stock. The following table summarizes the convertible preferred stock outstanding and liquidation preferences as of December 31, 2017: Per share Aggregate Dividend Shares price at liquidation per share Authorized Outstanding issuance preference amount (In millions, except for per share amounts) Series A 95.8 95.8 $ 0.06 $ 6.0 $ 0.01 Series A1 78.0 77.8 0.02 1.3 0.01 Series B 29.3 29.3 9.05 264.8 0.72 Series C 23.7 18.5 $ 19.10 352.6 $ 1.53 226.8 221.4 $ 624.7 Significant terms of the convertible preferred stock are as follows: Liquidation preference Upon a liquidation event, as defined in the amended and restated certificate of incorporation, the holders of Series A, Series A1, Series B, and Series C convertible preferred stock are entitled to receive, prior to and in preference to any distribution of the proceeds of such liquidation to common stockholders, an amount per share equal to $0.06, $0.02, $9.05, and $19.10, respectively, plus any declared but unpaid dividends on such shares. If the proceeds distributed among the holders of the preferred stock are insufficient to permit the Series A, Series A1, Series B, and Series C convertible preferred stock holders to receive the full payment noted above, then the entire proceeds legally available for distribution shall be distributed ratably among the holders of the preferred stock in proportion to the full preferential amount that each such holder is otherwise entitled to receive. F25 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 215/235

Dropbox S-1 | Interactive Prospectus Page 214 Page 216

Dropbox S-1 | Interactive Prospectus Page 214 Page 216