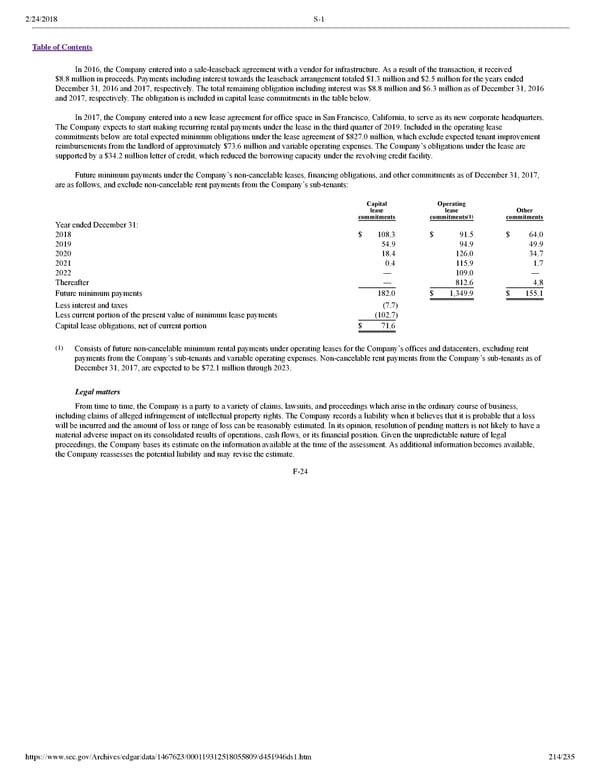

2/24/2018 S-1 Table of Contents In 2016, the Company entered into a saleleaseback agreement with a vendor for infrastructure. As a result of the transaction, it received $8.8 million in proceeds. Payments including interest towards the leaseback arrangement totaled $1.3 million and $2.5 million for the years ended December 31, 2016 and 2017, respectively. The total remaining obligation including interest was $8.8 million and $6.3 million as of December 31, 2016 and 2017, respectively. The obligation is included in capital lease commitments in the table below. In 2017, the Company entered into a new lease agreement for office space in San Francisco, California, to serve as its new corporate headquarters. The Company expects to start making recurring rental payments under the lease in the third quarter of 2019. Included in the operating lease commitments below are total expected minimum obligations under the lease agreement of $827.0 million, which exclude expected tenant improvement reimbursements from the landlord of approximately $73.6 million and variable operating expenses. The Company’s obligations under the lease are supported by a $34.2 million letter of credit, which reduced the borrowing capacity under the revolving credit facility. Future minimum payments under the Company’s noncancelable leases, financing obligations, and other commitments as of December 31, 2017, are as follows, and exclude noncancelable rent payments from the Company’s subtenants: Capital Operating lease lease Other (1) commitments commitments commitments Year ended December 31: 2018 $ 108.3 $ 91.5 $ 64.0 2019 54.9 94.9 49.9 2020 18.4 126.0 34.7 2021 0.4 115.9 1.7 2022 — 109.0 — Thereafter — 812.6 4.8 Future minimum payments 182.0 $ 1,349.9 $ 155.1 Less interest and taxes (7.7) Less current portion of the present value of minimum lease payments (102.7) Capital lease obligations, net of current portion $ 71.6 (1) Consists of future noncancelable minimum rental payments under operating leases for the Company’s offices and datacenters, excluding rent payments from the Company’s subtenants and variable operating expenses. Noncancelable rent payments from the Company’s subtenants as of December 31, 2017, are expected to be $72.1 million through 2023. Legal matters From time to time, the Company is a party to a variety of claims, lawsuits, and proceedings which arise in the ordinary course of business, including claims of alleged infringement of intellectual property rights. The Company records a liability when it believes that it is probable that a loss will be incurred and the amount of loss or range of loss can be reasonably estimated. In its opinion, resolution of pending matters is not likely to have a material adverse impact on its consolidated results of operations, cash flows, or its financial position. Given the unpredictable nature of legal proceedings, the Company bases its estimate on the information available at the time of the assessment. As additional information becomes available, the Company reassesses the potential liability and may revise the estimate. F24 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 214/235

Dropbox S-1 | Interactive Prospectus Page 213 Page 215

Dropbox S-1 | Interactive Prospectus Page 213 Page 215