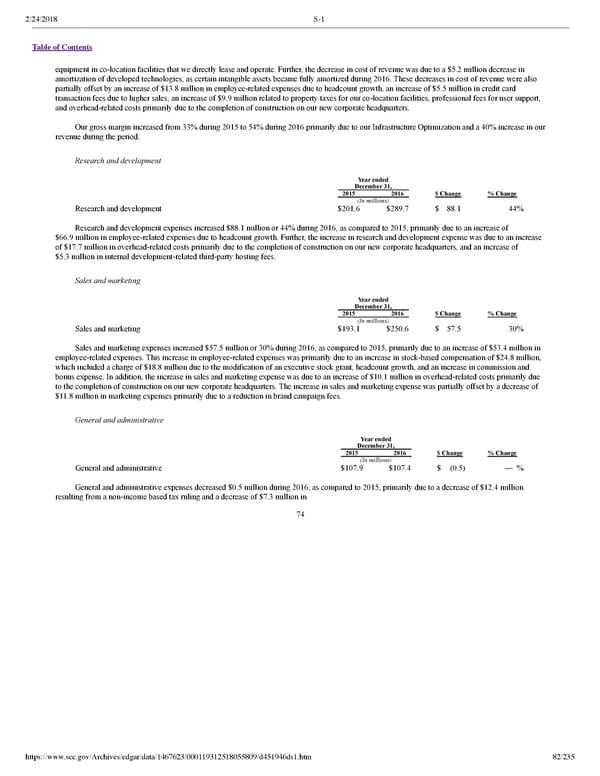

2/24/2018 S-1 Table of Contents equipment in colocation facilities that we directly lease and operate. Further, the decrease in cost of revenue was due to a $5.2 million decrease in amortization of developed technologies, as certain intangible assets became fully amortized during 2016. These decreases in cost of revenue were also partially offset by an increase of $13.8 million in employeerelated expenses due to headcount growth, an increase of $5.5 million in credit card transaction fees due to higher sales, an increase of $9.9 million related to property taxes for our colocation facilities, professional fees for user support, and overheadrelated costs primarily due to the completion of construction on our new corporate headquarters. Our gross margin increased from 33% during 2015 to 54% during 2016 primarily due to our Infrastructure Optimization and a 40% increase in our revenue during the period. Research and development Year ended December 31, 2015 2016 $ Change % Change (In millions) Research and development $201.6 $289.7 $ 88.1 44% Research and development expenses increased $88.1 million or 44% during 2016, as compared to 2015, primarily due to an increase of $66.9 million in employeerelated expenses due to headcount growth. Further, the increase in research and development expense was due to an increase of $17.7 million in overheadrelated costs primarily due to the completion of construction on our new corporate headquarters, and an increase of $5.3 million in internal developmentrelated thirdparty hosting fees. Sales and marketing Year ended December 31, 2015 2016 $ Change % Change (In millions) Sales and marketing $193.1 $250.6 $ 57.5 30% Sales and marketing expenses increased $57.5 million or 30% during 2016, as compared to 2015, primarily due to an increase of $53.4 million in employeerelated expenses. This increase in employeerelated expenses was primarily due to an increase in stockbased compensation of $24.8 million, which included a charge of $18.8 million due to the modification of an executive stock grant, headcount growth, and an increase in commission and bonus expense. In addition, the increase in sales and marketing expense was due to an increase of $10.1 million in overheadrelated costs primarily due to the completion of construction on our new corporate headquarters. The increase in sales and marketing expense was partially offset by a decrease of $11.8 million in marketing expenses primarily due to a reduction in brand campaign fees. General and administrative Year ended December 31, 2015 2016 $ Change % Change (In millions) General and administrative $107.9 $107.4 $(0.5) — % General and administrative expenses decreased $0.5 million during 2016, as compared to 2015, primarily due to a decrease of $12.4 million resulting from a nonincome based tax ruling and a decrease of $7.3 million in 74 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 82/235

Dropbox S-1 | Interactive Prospectus Page 81 Page 83

Dropbox S-1 | Interactive Prospectus Page 81 Page 83