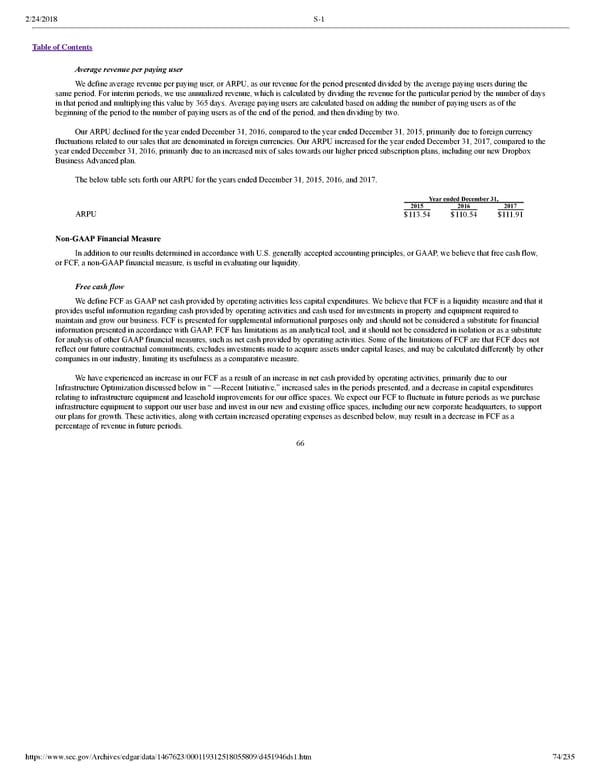

2/24/2018 S-1 Table of Contents Average revenue per paying user We define average revenue per paying user, or ARPU, as our revenue for the period presented divided by the average paying users during the same period. For interim periods, we use annualized revenue, which is calculated by dividing the revenue for the particular period by the number of days in that period and multiplying this value by 365 days. Average paying users are calculated based on adding the number of paying users as of the beginning of the period to the number of paying users as of the end of the period, and then dividing by two. Our ARPU declined for the year ended December 31, 2016, compared to the year ended December 31, 2015, primarily due to foreign currency fluctuations related to our sales that are denominated in foreign currencies. Our ARPU increased for the year ended December 31, 2017, compared to the year ended December 31, 2016, primarily due to an increased mix of sales towards our higher priced subscription plans, including our new Dropbox Business Advanced plan. The below table sets forth our ARPU for the years ended December 31, 2015, 2016, and 2017. Year ended December 31, 2015 2016 2017 ARPU $113.54 $110.54 $111.91 NonGAAP Financial Measure In addition to our results determined in accordance with U.S. generally accepted accounting principles, or GAAP, we believe that free cash flow, or FCF, a nonGAAP financial measure, is useful in evaluating our liquidity. Free cash flow We define FCF as GAAP net cash provided by operating activities less capital expenditures. We believe that FCF is a liquidity measure and that it provides useful information regarding cash provided by operating activities and cash used for investments in property and equipment required to maintain and grow our business. FCF is presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with GAAP. FCF has limitations as an analytical tool, and it should not be considered in isolation or as a substitute for analysis of other GAAP financial measures, such as net cash provided by operating activities. Some of the limitations of FCF are that FCF does not reflect our future contractual commitments, excludes investments made to acquire assets under capital leases, and may be calculated differently by other companies in our industry, limiting its usefulness as a comparative measure. We have experienced an increase in our FCF as a result of an increase in net cash provided by operating activities, primarily due to our Infrastructure Optimization discussed below in “ —Recent Initiative,” increased sales in the periods presented, and a decrease in capital expenditures relating to infrastructure equipment and leasehold improvements for our office spaces. We expect our FCF to fluctuate in future periods as we purchase infrastructure equipment to support our user base and invest in our new and existing office spaces, including our new corporate headquarters, to support our plans for growth. These activities, along with certain increased operating expenses as described below, may result in a decrease in FCF as a percentage of revenue in future periods. 66 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 74/235

Dropbox S-1 | Interactive Prospectus Page 73 Page 75

Dropbox S-1 | Interactive Prospectus Page 73 Page 75