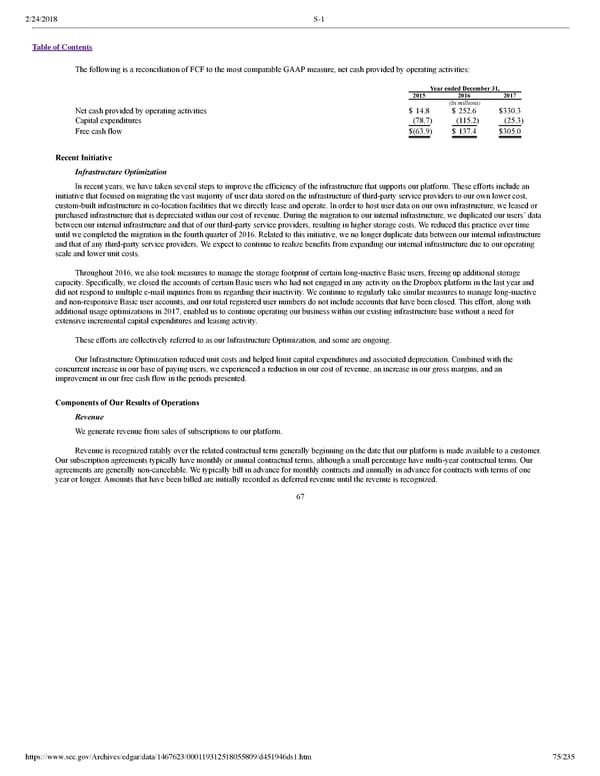

2/24/2018 S-1 Table of Contents The following is a reconciliation of FCF to the most comparable GAAP measure, net cash provided by operating activities: Year ended December 31, 2015 2016 2017 (In millions) Net cash provided by operating activities $ 14.8 $ 252.6 $330.3 Capital expenditures (78.7) (115.2) (25.3) Free cash flow $(63.9) $ 137.4 $305.0 Recent Initiative Infrastructure Optimization In recent years, we have taken several steps to improve the efficiency of the infrastructure that supports our platform. These efforts include an initiative that focused on migrating the vast majority of user data stored on the infrastructure of thirdparty service providers to our own lower cost, custombuilt infrastructure in colocation facilities that we directly lease and operate. In order to host user data on our own infrastructure, we leased or purchased infrastructure that is depreciated within our cost of revenue. During the migration to our internal infrastructure, we duplicated our users’ data between our internal infrastructure and that of our thirdparty service providers, resulting in higher storage costs. We reduced this practice over time until we completed the migration in the fourth quarter of 2016. Related to this initiative, we no longer duplicate data between our internal infrastructure and that of any thirdparty service providers. We expect to continue to realize benefits from expanding our internal infrastructure due to our operating scale and lower unit costs. Throughout 2016, we also took measures to manage the storage footprint of certain longinactive Basic users, freeing up additional storage capacity. Specifically, we closed the accounts of certain Basic users who had not engaged in any activity on the Dropbox platform in the last year and did not respond to multiple email inquiries from us regarding their inactivity. We continue to regularly take similar measures to manage longinactive and nonresponsive Basic user accounts, and our total registered user numbers do not include accounts that have been closed. This effort, along with additional usage optimizations in 2017, enabled us to continue operating our business within our existing infrastructure base without a need for extensive incremental capital expenditures and leasing activity. These efforts are collectively referred to as our Infrastructure Optimization, and some are ongoing. Our Infrastructure Optimization reduced unit costs and helped limit capital expenditures and associated depreciation. Combined with the concurrent increase in our base of paying users, we experienced a reduction in our cost of revenue, an increase in our gross margins, and an improvement in our free cash flow in the periods presented. Components of Our Results of Operations Revenue We generate revenue from sales of subscriptions to our platform. Revenue is recognized ratably over the related contractual term generally beginning on the date that our platform is made available to a customer. Our subscription agreements typically have monthly or annual contractual terms, although a small percentage have multiyear contractual terms. Our agreements are generally noncancelable. We typically bill in advance for monthly contracts and annually in advance for contracts with terms of one year or longer. Amounts that have been billed are initially recorded as deferred revenue until the revenue is recognized. 67 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 75/235

Dropbox S-1 | Interactive Prospectus Page 74 Page 76

Dropbox S-1 | Interactive Prospectus Page 74 Page 76