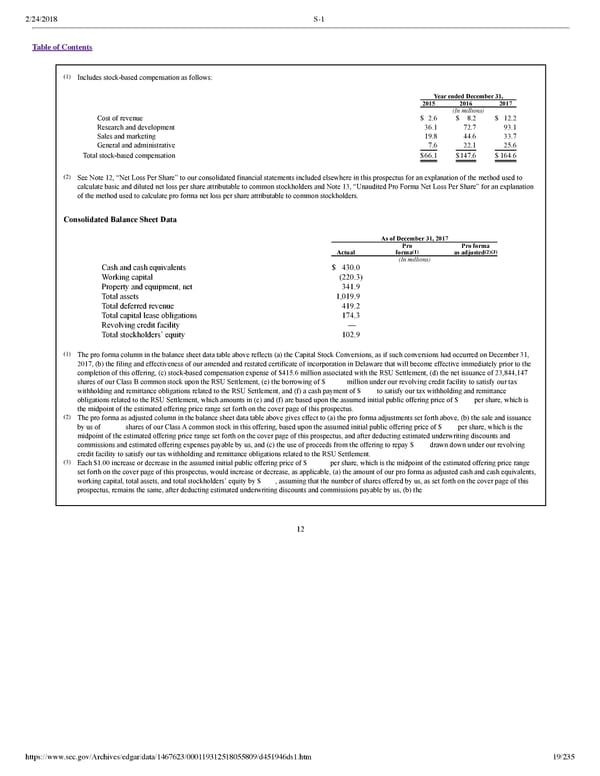

2/24/2018 S-1 Table of Contents (1) Includes stockbased compensation as follows: Year ended December 31, 2015 2016 2017 (In millions) Cost of revenue $ 2.6 $ 8.2 $ 12.2 Research and development 36.1 72.7 93.1 Sales and marketing 19.8 44.6 33.7 General and administrative 7.6 22.1 25.6 Total stockbased compensation $66.1 $147.6 $ 164.6 (2) See Note 12, “Net Loss Per Share” to our consolidated financial statements included elsewhere in this prospectus for an explanation of the method used to calculate basic and diluted net loss per share attributable to common stockholders and Note 13, “Unaudited Pro Forma Net Loss Per Share” for an explanation of the method used to calculate pro forma net loss per share attributable to common stockholders. Consolidated Balance Sheet Data As of December 31, 2017 Pro Pro forma (1) (2)(3) Actual forma as adjusted (In millions) Cash and cash equivalents $ 430.0 Working capital (220.3) Property and equipment, net 341.9 Total assets 1,019.9 Total deferred revenue 419.2 Total capital lease obligations 174.3 Revolving credit facility — Total stockholders’ equity 102.9 (1) The pro forma column in the balance sheet data table above reflects (a) the Capital Stock Conversions, as if such conversions had occurred on December 31, 2017, (b) the filing and effectiveness of our amended and restated certificate of incorporation in Delaware that will become effective immediately prior to the completion of this offering, (c) stockbased compensation expense of $415.6 million associated with the RSU Settlement, (d) the net issuance of 23,844,147 shares of our Class B common stock upon the RSU Settlement, (e) the borrowing of $ million under our revolving credit facility to satisfy our tax withholding and remittance obligations related to the RSU Settlement, and (f) a cash payment of $ to satisfy our tax withholding and remittance obligations related to the RSU Settlement, which amounts in (e) and (f) are based upon the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus. (2) The pro forma as adjusted column in the balance sheet data table above gives effect to (a) the pro forma adjustments set forth above, (b) the sale and issuance by us of shares of our Class A common stock in this offering, based upon the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, and (c) the use of proceeds from the offering to repay $ drawn down under our revolving credit facility to satisfy our tax withholding and remittance obligations related to the RSU Settlement. (3) Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase or decrease, as applicable, (a) the amount of our pro forma as adjusted cash and cash equivalents, working capital, total assets, and total stockholders’ equity by $ , assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, after deducting estimated underwriting discounts and commissions payable by us, (b) the 12 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 19/235

Dropbox S-1 | Interactive Prospectus Page 18 Page 20

Dropbox S-1 | Interactive Prospectus Page 18 Page 20