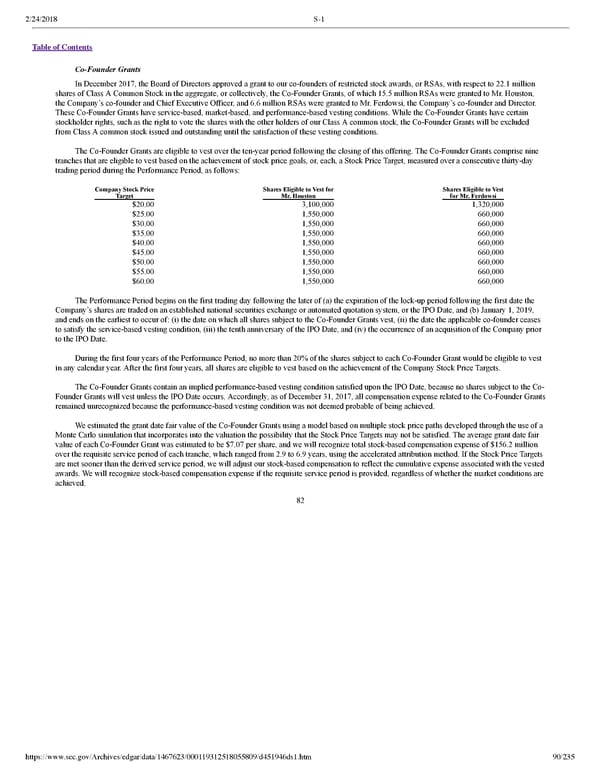

2/24/2018 S-1 Table of Contents CoFounder Grants In December 2017, the Board of Directors approved a grant to our cofounders of restricted stock awards, or RSAs, with respect to 22.1 million shares of Class A Common Stock in the aggregate, or collectively, the CoFounder Grants, of which 15.5 million RSAs were granted to Mr. Houston, the Company’s cofounder and Chief Executive Officer, and 6.6 million RSAs were granted to Mr. Ferdowsi, the Company’s cofounder and Director. These CoFounder Grants have servicebased, marketbased, and performancebased vesting conditions. While the CoFounder Grants have certain stockholder rights, such as the right to vote the shares with the other holders of our Class A common stock, the CoFounder Grants will be excluded from Class A common stock issued and outstanding until the satisfaction of these vesting conditions. The CoFounder Grants are eligible to vest over the tenyear period following the closing of this offering. The CoFounder Grants comprise nine tranches that are eligible to vest based on the achievement of stock price goals, or, each, a Stock Price Target, measured over a consecutive thirtyday trading period during the Performance Period, as follows: Company Stock Price Shares Eligible to Vest for Shares Eligible to Vest Target Mr. Houston for Mr. Ferdowsi $20.00 3,100,000 1,320,000 $25.00 1,550,000 660,000 $30.00 1,550,000 660,000 $35.00 1,550,000 660,000 $40.00 1,550,000 660,000 $45.00 1,550,000 660,000 $50.00 1,550,000 660,000 $55.00 1,550,000 660,000 $60.00 1,550,000 660,000 The Performance Period begins on the first trading day following the later of (a) the expiration of the lockup period following the first date the Company’s shares are traded on an established national securities exchange or automated quotation system, or the IPO Date, and (b) January 1, 2019, and ends on the earliest to occur of: (i) the date on which all shares subject to the CoFounder Grants vest, (ii) the date the applicable cofounder ceases to satisfy the servicebased vesting condition, (iii) the tenth anniversary of the IPO Date, and (iv) the occurrence of an acquisition of the Company prior to the IPO Date. During the first four years of the Performance Period, no more than 20% of the shares subject to each CoFounder Grant would be eligible to vest in any calendar year. After the first four years, all shares are eligible to vest based on the achievement of the Company Stock Price Targets. The CoFounder Grants contain an implied performancebased vesting condition satisfied upon the IPO Date, because no shares subject to the Co Founder Grants will vest unless the IPO Date occurs. Accordingly, as of December 31, 2017, all compensation expense related to the CoFounder Grants remained unrecognized because the performancebased vesting condition was not deemed probable of being achieved. We estimated the grant date fair value of the CoFounder Grants using a model based on multiple stock price paths developed through the use of a Monte Carlo simulation that incorporates into the valuation the possibility that the Stock Price Targets may not be satisfied. The average grant date fair value of each CoFounder Grant was estimated to be $7.07 per share, and we will recognize total stockbased compensation expense of $156.2 million over the requisite service period of each tranche, which ranged from 2.9 to 6.9 years, using the accelerated attribution method. If the Stock Price Targets are met sooner than the derived service period, we will adjust our stockbased compensation to reflect the cumulative expense associated with the vested awards. We will recognize stockbased compensation expense if the requisite service period is provided, regardless of whether the market conditions are achieved. 82 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 90/235

Dropbox S-1 | Interactive Prospectus Page 89 Page 91

Dropbox S-1 | Interactive Prospectus Page 89 Page 91