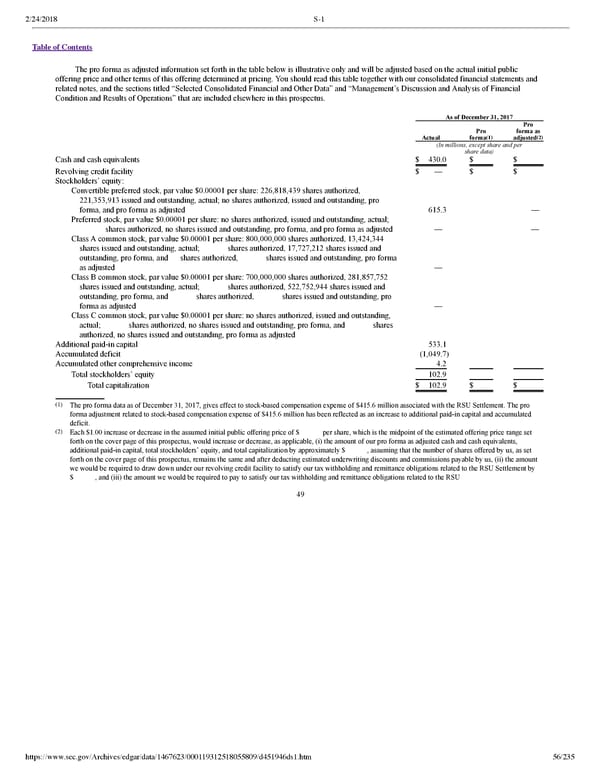

2/24/2018 S-1 Table of Contents The pro forma as adjusted information set forth in the table below is illustrative only and will be adjusted based on the actual initial public offering price and other terms of this offering determined at pricing. You should read this table together with our consolidated financial statements and related notes, and the sections titled “Selected Consolidated Financial and Other Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” that are included elsewhere in this prospectus. As of December 31, 2017 Pro Pro forma as (1) (2) Actual forma adjusted (In millions, except share and per share data) Cash and cash equivalents $ 430.0 $ $ Revolving credit facility $ — $ $ Stockholders’ equity: Convertible preferred stock, par value $0.00001 per share: 226,818,439 shares authorized, 221,353,913 issued and outstanding, actual; no shares authorized, issued and outstanding, pro forma, and pro forma as adjusted 615.3 — Preferred stock, par value $0.00001 per share: no shares authorized, issued and outstanding, actual; shares authorized, no shares issued and outstanding, pro forma, and pro forma as adjusted — — Class A common stock, par value $0.00001 per share: 800,000,000 shares authorized, 13,424,344 shares issued and outstanding, actual; shares authorized, 17,727,212 shares issued and outstanding, pro forma, and shares authorized, shares issued and outstanding, pro forma as adjusted — Class B common stock, par value $0.00001 per share: 700,000,000 shares authorized, 281,857,752 shares issued and outstanding, actual; shares authorized, 522,752,944 shares issued and outstanding, pro forma, and shares authorized, shares issued and outstanding, pro forma as adjusted — Class C common stock, par value $0.00001 per share: no shares authorized, issued and outstanding, actual; shares authorized, no shares issued and outstanding, pro forma, and shares authorized, no shares issued and outstanding, pro forma as adjusted Additional paidin capital 533.1 Accumulated deficit (1,049.7) Accumulated other comprehensive income 4.2 Total stockholders’ equity 102.9 Total capitalization $ 102.9 $ $ (1) The pro forma data as of December 31, 2017, gives effect to stockbased compensation expense of $415.6 million associated with the RSU Settlement. The pro forma adjustment related to stockbased compensation expense of $415.6 million has been reflected as an increase to additional paidin capital and accumulated deficit. (2) Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase or decrease, as applicable, (i) the amount of our pro forma as adjusted cash and cash equivalents, additional paidin capital, total stockholders’ equity, and total capitalization by approximately $ , assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions payable by us, (ii) the amount we would be required to draw down under our revolving credit facility to satisfy our tax withholding and remittance obligations related to the RSU Settlement by $ , and (iii) the amount we would be required to pay to satisfy our tax withholding and remittance obligations related to the RSU 49 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 56/235

Dropbox S-1 | Interactive Prospectus Page 55 Page 57

Dropbox S-1 | Interactive Prospectus Page 55 Page 57