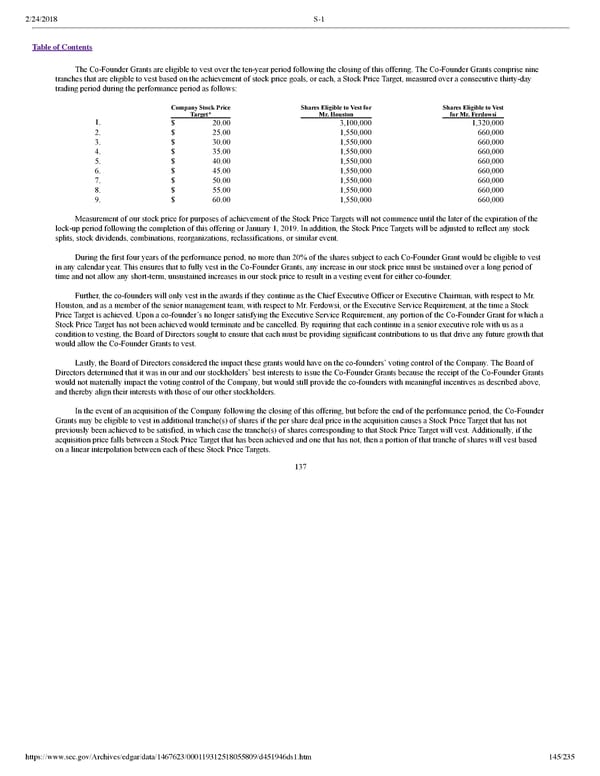

2/24/2018 S-1 Table of Contents The CoFounder Grants are eligible to vest over the tenyear period following the closing of this offering. The CoFounder Grants comprise nine tranches that are eligible to vest based on the achievement of stock price goals, or each, a Stock Price Target, measured over a consecutive thirtyday trading period during the performance period as follows: Company Stock Price Shares Eligible to Vest forShares Eligible to Vest Target* Mr. Houston for Mr. Ferdowsi 1. $ 20.00 3,100,000 1,320,000 2. $ 25.00 1,550,000 660,000 3. $ 30.00 1,550,000 660,000 4. $ 35.00 1,550,000 660,000 5. $ 40.00 1,550,000 660,000 6. $ 45.00 1,550,000 660,000 7. $ 50.00 1,550,000 660,000 8. $ 55.00 1,550,000 660,000 9. $ 60.00 1,550,000 660,000 Measurement of our stock price for purposes of achievement of the Stock Price Targets will not commence until the later of the expiration of the lockup period following the completion of this offering or January 1, 2019. In addition, the Stock Price Targets will be adjusted to reflect any stock splits, stock dividends, combinations, reorganizations, reclassifications, or similar event. During the first four years of the performance period, no more than 20% of the shares subject to each CoFounder Grant would be eligible to vest in any calendar year. This ensures that to fully vest in the CoFounder Grants, any increase in our stock price must be sustained over a long period of time and not allow any shortterm, unsustained increases in our stock price to result in a vesting event for either cofounder. Further, the cofounders will only vest in the awards if they continue as the Chief Executive Officer or Executive Chairman, with respect to Mr. Houston, and as a member of the senior management team, with respect to Mr. Ferdowsi, or the Executive Service Requirement, at the time a Stock Price Target is achieved. Upon a cofounder’s no longer satisfying the Executive Service Requirement, any portion of the CoFounder Grant for which a Stock Price Target has not been achieved would terminate and be cancelled. By requiring that each continue in a senior executive role with us as a condition to vesting, the Board of Directors sought to ensure that each must be providing significant contributions to us that drive any future growth that would allow the CoFounder Grants to vest. Lastly, the Board of Directors considered the impact these grants would have on the cofounders’ voting control of the Company. The Board of Directors determined that it was in our and our stockholders’ best interests to issue the CoFounder Grants because the receipt of the CoFounder Grants would not materially impact the voting control of the Company, but would still provide the cofounders with meaningful incentives as described above, and thereby align their interests with those of our other stockholders. In the event of an acquisition of the Company following the closing of this offering, but before the end of the performance period, the CoFounder Grants may be eligible to vest in additional tranche(s) of shares if the per share deal price in the acquisition causes a Stock Price Target that has not previously been achieved to be satisfied, in which case the tranche(s) of shares corresponding to that Stock Price Target will vest. Additionally, if the acquisition price falls between a Stock Price Target that has been achieved and one that has not, then a portion of that tranche of shares will vest based on a linear interpolation between each of these Stock Price Targets. 137 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 145/235

Dropbox S-1 | Interactive Prospectus Page 144 Page 146

Dropbox S-1 | Interactive Prospectus Page 144 Page 146