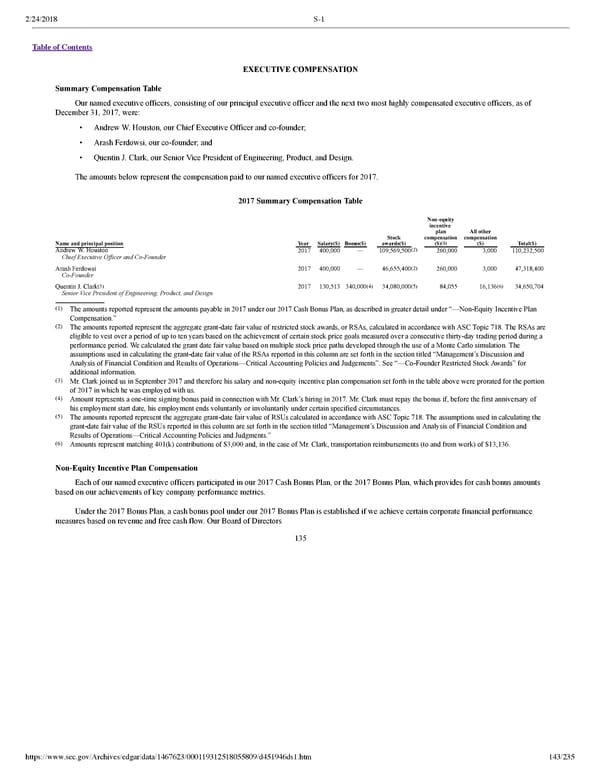

2/24/2018 S-1 Table of Contents EXECUTIVE COMPENSATION Summary Compensation Table Our named executive officers, consisting of our principal executive officer and the next two most highly compensated executive officers, as of December 31, 2017, were: • Andrew W. Houston, our Chief Executive Officer and cofounder; • Arash Ferdowsi, our cofounder; and • Quentin J. Clark, our Senior Vice President of Engineering, Product, and Design. The amounts below represent the compensation paid to our named executive officers for 2017. 2017 Summary Compensation Table Nonequity incentive plan All other Stock compensationcompensation (1) Name and principal position Year Salary($) Bonus($) awards($) ($) ($) Total($) (2) Andrew W. Houston 2017 400,000 — 109,569,500 260,000 3,000 110,232,500 Chief Executive Officer and CoFounder (2) Arash Ferdowsi 2017 400,000 — 46,655,400 260,000 3,000 47,318,400 CoFounder (3) (4) (5) (6) Quentin J. Clark 2017 130,513 340,000 34,080,000 84,055 16,136 34,650,704 Senior Vice President of Engineering, Product, and Design (1) The amounts reported represent the amounts payable in 2017 under our 2017 Cash Bonus Plan, as described in greater detail under “—NonEquity Incentive Plan Compensation.” (2) The amounts reported represent the aggregate grantdate fair value of restricted stock awards, or RSAs, calculated in accordance with ASC Topic 718. The RSAs are eligible to vest over a period of up to ten years based on the achievement of certain stock price goals measured over a consecutive thirtyday trading period during a performance period. We calculated the grant date fair value based on multiple stock price paths developed through the use of a Monte Carlo simulation. The assumptions used in calculating the grantdate fair value of the RSAs reported in this column are set forth in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Judgements”. See “—CoFounder Restricted Stock Awards” for additional information. (3) Mr. Clark joined us in September 2017 and therefore his salary and nonequity incentive plan compensation set forth in the table above were prorated for the portion of 2017 in which he was employed with us. (4) Amount represents a onetime signing bonus paid in connection with Mr. Clark’s hiring in 2017. Mr. Clark must repay the bonus if, before the first anniversary of his employment start date, his employment ends voluntarily or involuntarily under certain specified circumstances. (5) The amounts reported represent the aggregate grantdate fair value of RSUs calculated in accordance with ASC Topic 718. The assumptions used in calculating the grantdate fair value of the RSUs reported in this column are set forth in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Judgments.” (6) Amounts represent matching 401(k) contributions of $3,000 and, in the case of Mr. Clark, transportation reimbursements (to and from work) of $13,136. NonEquity Incentive Plan Compensation Each of our named executive officers participated in our 2017 Cash Bonus Plan, or the 2017 Bonus Plan, which provides for cash bonus amounts based on our achievements of key company performance metrics. Under the 2017 Bonus Plan, a cash bonus pool under our 2017 Bonus Plan is established if we achieve certain corporate financial performance measures based on revenue and free cash flow. Our Board of Directors 135 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 143/235

Dropbox S-1 | Interactive Prospectus Page 142 Page 144

Dropbox S-1 | Interactive Prospectus Page 142 Page 144