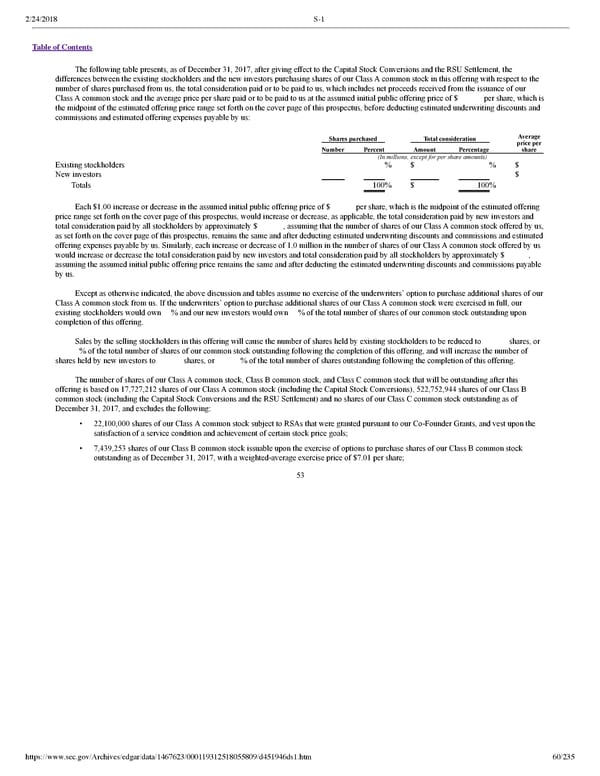

2/24/2018 S-1 Table of Contents The following table presents, as of December 31, 2017, after giving effect to the Capital Stock Conversions and the RSU Settlement, the differences between the existing stockholders and the new investors purchasing shares of our Class A common stock in this offering with respect to the number of shares purchased from us, the total consideration paid or to be paid to us, which includes net proceeds received from the issuance of our Class A common stock and the average price per share paid or to be paid to us at the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, before deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us: Average Shares purchased Total consideration price per Number Percent Amount Percentage share (In millions, except for per share amounts) Existing stockholders % $ % $ New investors $ Totals 100% $ 100% Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase or decrease, as applicable, the total consideration paid by new investors and total consideration paid by all stockholders by approximately $ , assuming that the number of shares of our Class A common stock offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase or decrease of 1.0 million in the number of shares of our Class A common stock offered by us would increase or decrease the total consideration paid by new investors and total consideration paid by all stockholders by approximately $ , assuming the assumed initial public offering price remains the same and after deducting the estimated underwriting discounts and commissions payable by us. Except as otherwise indicated, the above discussion and tables assume no exercise of the underwriters’ option to purchase additional shares of our Class A common stock from us. If the underwriters’ option to purchase additional shares of our Class A common stock were exercised in full, our existing stockholders would own % and our new investors would own % of the total number of shares of our common stock outstanding upon completion of this offering. Sales by the selling stockholders in this offering will cause the number of shares held by existing stockholders to be reduced to shares, or % of the total number of shares of our common stock outstanding following the completion of this offering, and will increase the number of shares held by new investors to shares, or % of the total number of shares outstanding following the completion of this offering. The number of shares of our Class A common stock, Class B common stock, and Class C common stock that will be outstanding after this offering is based on 17,727,212 shares of our Class A common stock (including the Capital Stock Conversions), 522,752,944 shares of our Class B common stock (including the Capital Stock Conversions and the RSU Settlement) and no shares of our Class C common stock outstanding as of December 31, 2017, and excludes the following: • 22,100,000 shares of our Class A common stock subject to RSAs that were granted pursuant to our CoFounder Grants, and vest upon the satisfaction of a service condition and achievement of certain stock price goals; • 7,439,253 shares of our Class B common stock issuable upon the exercise of options to purchase shares of our Class B common stock outstanding as of December 31, 2017, with a weightedaverage exercise price of $7.01 per share; 53 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 60/235

Dropbox S-1 | Interactive Prospectus Page 59 Page 61

Dropbox S-1 | Interactive Prospectus Page 59 Page 61