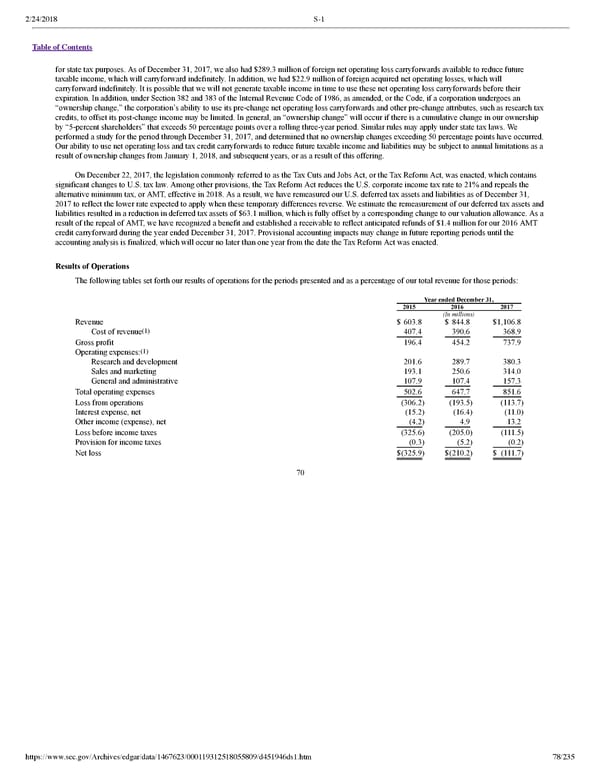

2/24/2018 S-1 Table of Contents for state tax purposes. As of December 31, 2017, we also had $289.3 million of foreign net operating loss carryforwards available to reduce future taxable income, which will carryforward indefinitely. In addition, we had $22.9 million of foreign acquired net operating losses, which will carryforward indefinitely. It is possible that we will not generate taxable income in time to use these net operating loss carryforwards before their expiration. In addition, under Section 382 and 383 of the Internal Revenue Code of 1986, as amended, or the Code, if a corporation undergoes an “ownership change,” the corporation’s ability to use its prechange net operating loss carryforwards and other prechange attributes, such as research tax credits, to offset its postchange income may be limited. In general, an “ownership change” will occur if there is a cumulative change in our ownership by “5percent shareholders” that exceeds 50 percentage points over a rolling threeyear period. Similar rules may apply under state tax laws. We performed a study for the period through December 31, 2017, and determined that no ownership changes exceeding 50 percentage points have occurred. Our ability to use net operating loss and tax credit carryforwards to reduce future taxable income and liabilities may be subject to annual limitations as a result of ownership changes from January 1, 2018, and subsequent years, or as a result of this offering. On December 22, 2017, the legislation commonly referred to as the Tax Cuts and Jobs Act, or the Tax Reform Act, was enacted, which contains significant changes to U.S. tax law. Among other provisions, the Tax Reform Act reduces the U.S. corporate income tax rate to 21% and repeals the alternative minimum tax, or AMT, effective in 2018. As a result, we have remeasured our U.S. deferred tax assets and liabilities as of December 31, 2017 to reflect the lower rate expected to apply when these temporary differences reverse. We estimate the remeasurement of our deferred tax assets and liabilities resulted in a reduction in deferred tax assets of $63.1 million, which is fully offset by a corresponding change to our valuation allowance. As a result of the repeal of AMT, we have recognized a benefit and established a receivable to reflect anticipated refunds of $1.4 million for our 2016 AMT credit carryforward during the year ended December 31, 2017. Provisional accounting impacts may change in future reporting periods until the accounting analysis is finalized, which will occur no later than one year from the date the Tax Reform Act was enacted. Results of Operations The following tables set forth our results of operations for the periods presented and as a percentage of our total revenue for those periods: Year ended December 31, 2015 2016 2017 (In millions) Revenue $ 603.8 $ 844.8 $1,106.8 (1) Cost of revenue 407.4 390.6 368.9 Gross profit 196.4 454.2 737.9 (1) Operating expenses: Research and development 201.6 289.7 380.3 Sales and marketing 193.1 250.6 314.0 General and administrative 107.9 107.4 157.3 Total operating expenses 502.6 647.7 851.6 Loss from operations (306.2) (193.5) (113.7) Interest expense, net (15.2) (16.4) (11.0) Other income (expense), net (4.2) 4.9 13.2 Loss before income taxes (325.6) (205.0) (111.5) Provision for income taxes (0.3) (5.2) (0.2) Net loss $(325.9) $(210.2) $ (111.7) 70 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 78/235

Dropbox S-1 | Interactive Prospectus Page 77 Page 79

Dropbox S-1 | Interactive Prospectus Page 77 Page 79