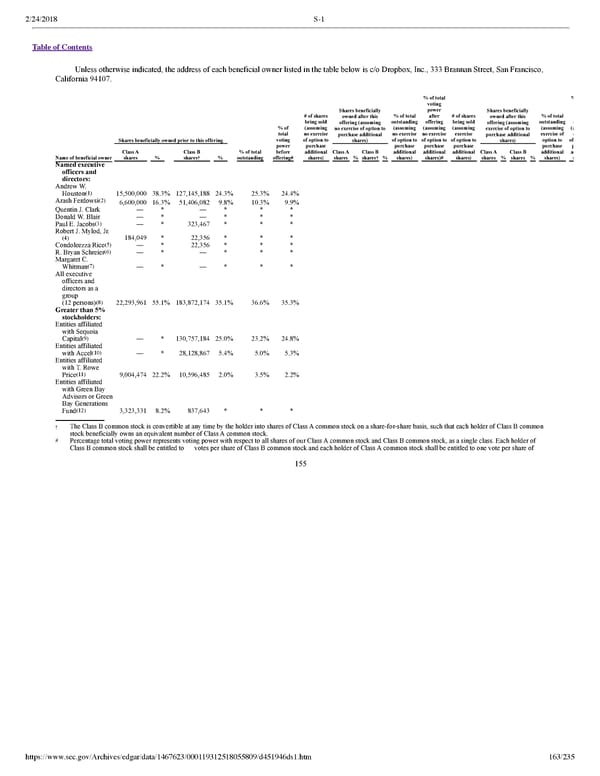

2/24/2018 S-1 Table of Contents Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o Dropbox, Inc., 333 Brannan Street, San Francisco, California 94107. % of total % voting power Shares beneficially Shares beneficially # of shares % of total after # of shares % of total owned after this owned after this being sold outstandingofferingbeing sold outstandingo offering (assuming offering (assuming % of (assuming (assuming(assuming(assuming (assuming(a no exercise of option to exercise of option to total no exercise no exerciseno exerciseexercise exercise ofe purchase additional purchase additional Shares beneficially owned prior to this offering voting of option to shares) of option to of option to of option to shares) option to of power purchase purchase purchase purchase purchase p Class A Class B % of total before additionalClass A Class B additionaladditionaladditionalClass AClass B additionalad Name of beneficial owner shares % shares† % outstanding offering# shares) shares % shares† % shares) shares)# shares) shares % shares % shares) s Named executive officers and directors: Andrew W. (1) Houston 15,500,000 38.3% 127,145,188 24.3% 25.3% 24.4% (2) Arash Ferdowsi 6,600,000 16.3% 51,406,082 9.8% 10.3% 9.9% Quentin J. Clark — * — * * * Donald W. Blair — * — * * * (3) Paul E. Jacobs — * 323,467 * * * Robert J. Mylod, Jr. (4) 184,049 * 22,356 * * * (5) Condoleezza Rice — * 22,356 * * * (6) R. Bryan Schreier — * — * * * Margaret C. (7) Whitman — * — * * * All executive officers and directors as a group (8) (12 persons) 22,293,961 55.1% 183,872,174 35.1% 36.6% 35.3% Greater than 5% stockholders: Entities affiliated with Sequoia (9) Capital — * 130,757,184 25.0% 23.2% 24.8% Entities affiliated (10) with Accel — * 28,128,867 5.4% 5.0% 5.3% Entities affiliated with T. Rowe (11) Price 9,004,474 22.2% 10,596,485 2.0% 3.5% 2.2% Entities affiliated with Green Bay Advisors or Green Bay Generations (12) Fund 3,323,331 8.2% 837,643 * * * † The Class B common stock is convertible at any time by the holder into shares of Class A common stock on a shareforshare basis, such that each holder of Class B common stock beneficially owns an equivalent number of Class A common stock. # Percentage total voting power represents voting power with respect to all shares of our Class A common stock and Class B common stock, as a single class. Each holder of Class B common stock shall be entitled to votes per share of Class B common stock and each holder of Class A common stock shall be entitled to one vote per share of 155 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 163/235

Dropbox S-1 | Interactive Prospectus Page 162 Page 164

Dropbox S-1 | Interactive Prospectus Page 162 Page 164