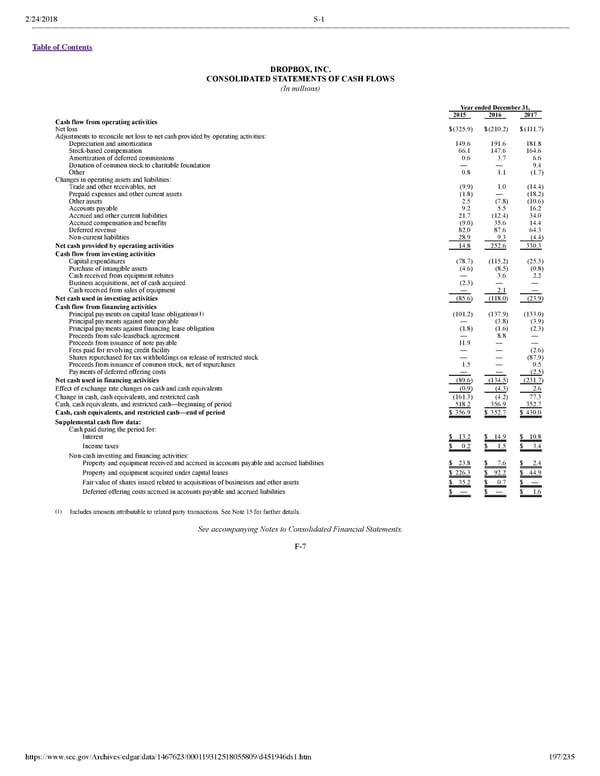

2/24/2018 S-1 Table of Contents DROPBOX, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Year ended December 31, 2015 2016 2017 Cash flow from operating activities Net loss $(325.9) $(210.2) $(111.7) Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization 149.6 191.6 181.8 Stockbased compensation 66.1 147.6 164.6 Amortization of deferred commissions 0.6 3.7 6.6 Donation of common stock to charitable foundation — — 9.4 Other 0.8 1.1 (1.7) Changes in operating assets and liabilities: Trade and other receivables, net (9.9) 1.0 (14.4) Prepaid expenses and other current assets (1.8) — (18.2) Other assets 2.5 (7.8) (10.6) Accounts payable 9.2 5.5 16.2 Accrued and other current liabilities 21.7 (12.4) 34.0 Accrued compensation and benefits (9.0) 35.6 14.4 Deferred revenue 82.0 87.6 64.3 Noncurrent liabilities 28.9 9.3 (4.4) Net cash provided by operating activities 14.8 252.6 330.3 Cash flow from investing activities Capital expenditures (78.7) (115.2) (25.3) Purchase of intangible assets (4.6) (8.5) (0.8) Cash received from equipment rebates — 3.6 2.2 Business acquisitions, net of cash acquired (2.3) — — Cash received from sales of equipment — 2.1 — Net cash used in investing activities (85.6) (118.0) (23.9) Cash flow from financing activities (1) Principal payments on capital lease obligations (101.2) (137.9) (133.0) Principal payments against note payable — (3.8) (3.9) Principal payments against financing lease obligation (1.8) (1.6) (2.3) Proceeds from saleleaseback agreement — 8.8 — Proceeds from issuance of note payable 11.9 — — Fees paid for revolving credit facility — — (2.6) Shares repurchased for tax withholdings on release of restricted stock — — (87.9) Proceeds from issuance of common stock, net of repurchases 1.5 — 0.5 Payments of deferred offering costs — — (2.5) Net cash used in financing activities (89.6) (134.5) (231.7) Effect of exchange rate changes on cash and cash equivalents (0.9) (4.3) 2.6 Change in cash, cash equivalents, and restricted cash (161.3) (4.2) 77.3 Cash, cash equivalents, and restricted cash—beginning of period 518.2 356.9 352.7 Cash, cash equivalents, and restricted cash—end of period $ 356.9 $ 352.7 $ 430.0 Supplemental cash flow data: Cash paid during the period for: Interest $ 13.2 $ 14.9 $ 10.8 Income taxes $ 0.2 $ 1.5 $ 3.4 Noncash investing and financing activities: Property and equipment received and accrued in accounts payable and accrued liabilities $ 23.8 $ 7.6 $ 2.4 Property and equipment acquired under capital leases $ 226.3 $ 92.2 $ 44.9 Fair value of shares issued related to acquisitions of businesses and other assets $ 35.2 $ 0.7 $ — Deferred offering costs accrued in accounts payable and accrued liabilities $ — $ — $ 1.6 (1) Includes amounts attributable to related party transactions. See Note 15 for further details. See accompanying Notes to Consolidated Financial Statements. F7 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 197/235

Dropbox S-1 | Interactive Prospectus Page 196 Page 198

Dropbox S-1 | Interactive Prospectus Page 196 Page 198