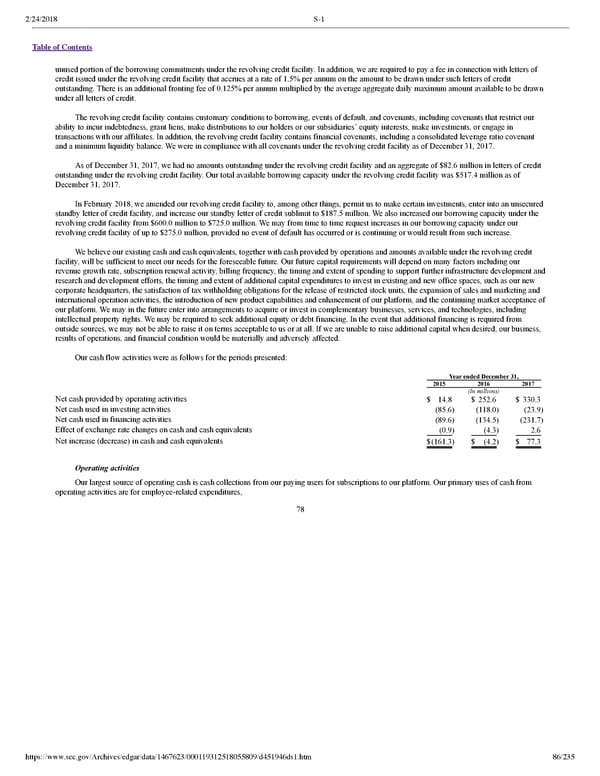

2/24/2018 S-1 Table of Contents unused portion of the borrowing commitments under the revolving credit facility. In addition, we are required to pay a fee in connection with letters of credit issued under the revolving credit facility that accrues at a rate of 1.5% per annum on the amount to be drawn under such letters of credit outstanding. There is an additional fronting fee of 0.125% per annum multiplied by the average aggregate daily maximum amount available to be drawn under all letters of credit. The revolving credit facility contains customary conditions to borrowing, events of default, and covenants, including covenants that restrict our ability to incur indebtedness, grant liens, make distributions to our holders or our subsidiaries’ equity interests, make investments, or engage in transactions with our affiliates. In addition, the revolving credit facility contains financial covenants, including a consolidated leverage ratio covenant and a minimum liquidity balance. We were in compliance with all covenants under the revolving credit facility as of December 31, 2017. As of December 31, 2017, we had no amounts outstanding under the revolving credit facility and an aggregate of $82.6 million in letters of credit outstanding under the revolving credit facility. Our total available borrowing capacity under the revolving credit facility was $517.4 million as of December 31, 2017. In February 2018, we amended our revolving credit facility to, among other things, permit us to make certain investments, enter into an unsecured standby letter of credit facility, and increase our standby letter of credit sublimit to $187.5 million. We also increased our borrowing capacity under the revolving credit facility from $600.0 million to $725.0 million. We may from time to time request increases in our borrowing capacity under our revolving credit facility of up to $275.0 million, provided no event of default has occurred or is continuing or would result from such increase. We believe our existing cash and cash equivalents, together with cash provided by operations and amounts available under the revolving credit facility, will be sufficient to meet our needs for the foreseeable future. Our future capital requirements will depend on many factors including our revenue growth rate, subscription renewal activity, billing frequency, the timing and extent of spending to support further infrastructure development and research and development efforts, the timing and extent of additional capital expenditures to invest in existing and new office spaces, such as our new corporate headquarters, the satisfaction of tax withholding obligations for the release of restricted stock units, the expansion of sales and marketing and international operation activities, the introduction of new product capabilities and enhancement of our platform, and the continuing market acceptance of our platform. We may in the future enter into arrangements to acquire or invest in complementary businesses, services, and technologies, including intellectual property rights. We may be required to seek additional equity or debt financing. In the event that additional financing is required from outside sources, we may not be able to raise it on terms acceptable to us or at all. If we are unable to raise additional capital when desired, our business, results of operations, and financial condition would be materially and adversely affected. Our cash flow activities were as follows for the periods presented: Year ended December 31, 2015 2016 2017 (In millions) Net cash provided by operating activities $ 14.8 $ 252.6 $ 330.3 Net cash used in investing activities (85.6) (118.0) (23.9) Net cash used in financing activities (89.6) (134.5) (231.7) Effect of exchange rate changes on cash and cash equivalents (0.9) (4.3) 2.6 Net increase (decrease) in cash and cash equivalents $(161.3) $ (4.2) $ 77.3 Operating activities Our largest source of operating cash is cash collections from our paying users for subscriptions to our platform. Our primary uses of cash from operating activities are for employeerelated expenditures, 78 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 86/235

Dropbox S-1 | Interactive Prospectus Page 85 Page 87

Dropbox S-1 | Interactive Prospectus Page 85 Page 87