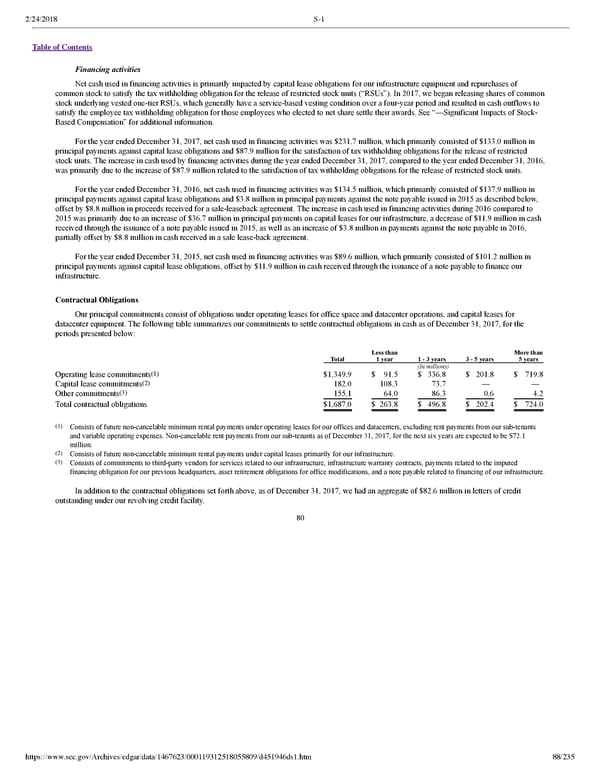

2/24/2018 S-1 Table of Contents Financing activities Net cash used in financing activities is primarily impacted by capital lease obligations for our infrastructure equipment and repurchases of common stock to satisfy the tax withholding obligation for the release of restricted stock units (“RSUs”). In 2017, we began releasing shares of common stock underlying vested onetier RSUs, which generally have a servicebased vesting condition over a fouryear period and resulted in cash outflows to satisfy the employee tax withholding obligation for those employees who elected to net share settle their awards. See “—Significant Impacts of Stock Based Compensation” for additional information. For the year ended December 31, 2017, net cash used in financing activities was $231.7 million, which primarily consisted of $133.0 million in principal payments against capital lease obligations and $87.9 million for the satisfaction of tax withholding obligations for the release of restricted stock units. The increase in cash used by financing activities during the year ended December 31, 2017, compared to the year ended December 31, 2016, was primarily due to the increase of $87.9 million related to the satisfaction of tax withholding obligations for the release of restricted stock units. For the year ended December 31, 2016, net cash used in financing activities was $134.5 million, which primarily consisted of $137.9 million in principal payments against capital lease obligations and $3.8 million in principal payments against the note payable issued in 2015 as described below, offset by $8.8 million in proceeds received for a saleleaseback agreement. The increase in cash used in financing activities during 2016 compared to 2015 was primarily due to an increase of $36.7 million in principal payments on capital leases for our infrastructure, a decrease of $11.9 million in cash received through the issuance of a note payable issued in 2015, as well as an increase of $3.8 million in payments against the note payable in 2016, partially offset by $8.8 million in cash received in a sale leaseback agreement. For the year ended December 31, 2015, net cash used in financing activities was $89.6 million, which primarily consisted of $101.2 million in principal payments against capital lease obligations, offset by $11.9 million in cash received through the issuance of a note payable to finance our infrastructure. Contractual Obligations Our principal commitments consist of obligations under operating leases for office space and datacenter operations, and capital leases for datacenter equipment. The following table summarizes our commitments to settle contractual obligations in cash as of December 31, 2017, for the periods presented below: Less than More than Total 1 year 1 3 years 3 5 years 5 years (In millions) (1) Operating lease commitments $1,349.9 $ 91.5 $ 336.8 $ 201.8 $ 719.8 (2) Capital lease commitments 182.0 108.3 73.7 — — (3) Other commitments 155.1 64.0 86.3 0.6 4.2 Total contractual obligations $1,687.0 $ 263.8 $ 496.8 $ 202.4 $ 724.0 (1) Consists of future noncancelable minimum rental payments under operating leases for our offices and datacenters, excluding rent payments from our subtenants and variable operating expenses. Noncancelable rent payments from our subtenants as of December 31, 2017, for the next six years are expected to be $72.1 million. (2) Consists of future noncancelable minimum rental payments under capital leases primarily for our infrastructure. (3) Consists of commitments to thirdparty vendors for services related to our infrastructure, infrastructure warranty contracts, payments related to the imputed financing obligation for our previous headquarters, asset retirement obligations for office modifications, and a note payable related to financing of our infrastructure. In addition to the contractual obligations set forth above, as of December 31, 2017, we had an aggregate of $82.6 million in letters of credit outstanding under our revolving credit facility. 80 https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946ds1.htm 88/235

Dropbox S-1 | Interactive Prospectus Page 87 Page 89

Dropbox S-1 | Interactive Prospectus Page 87 Page 89